This is Part 1 of our journey through the typical brewery: what we see, what should be there, and what the implications are on profit, growth, and legacy.

Out in the taproom it’s all smiles.

Out in the production area the team is brewin’ it up.

All is well in the brewery.

Or so it seems…

As we make our way towards the back office, something is off.

The temperature plummets.

The sky turns quickly, as the dark clouds swirl.

Anyone unfortunate enough to be trapped nearby can feel the energy being sucked out of the room.

I’m talking about the person, in charge of the back office responsibilities for your brewery. errrrrr

Cleaning the tanks, stacking the kegs, and negotiating with your most conniving distributor are all preferable to this one weekly activity.

Because in the typical brewery…

It’s fake-it-until-you-make-it with the financials.

A thankless job.

Sound familiar?

In the beginning…

When you first opened your doors you and the founders were in full hustle mode. Doing 130% of the work.

Grinding HARD. And that got you over the hump.

People started showing up to the taproom. Miraculously, some thought your beer was great and decided to tell their friends.

And then… it was off to the races.

First hires are usually taproom staff.

Then sales pick up so you add to the production team.

Sales pick up more and that gem in the taproom becomes the Taproom Manager, taking on more responsibility.

Sales continue to increase and the founders need help… BAD.

At this point, one of two things happens.

Scenario 1: Taproom Manager Turned Admin

The trusty Taproom Manager, in most cases, is looking for upward mobility so they take on more.

And some of this “more” ends up being the back office.

No joke, I see it all the time.

They are faking it.

Everyone knows it.

They even joke about it.

But the brewery cannot afford a full-time admin, and so they pick up the slack as best they can…

The problem is, whatever initial enthusiasm they had for these responsibilities quickly turns to… HATE.

(Hence the dark, soul-crushing storm clouds.)

They’re suited for organizing tasks during the day and customer facing activities at night.

They motivate the taproom team, are respected by the production team, and joke with the sales team.

You know the person I am talking about… every brewery has one!

So it shouldn’t come as a surprise that this person ends up DESPISING the back office role.

The rest of the team can feel it.

Scenario 2: You, Your Worst Enemy

If it’s not the Taproom Manager charged with this bottom-of-the-priority-list task, then usually…

It’s YOU.

And between the 100 other hats you wear, the Weekly Finance Hat is a crappy one indeed.

Usually at a time where you know there are a thousand other things you could be doing to move the business forward…

You shut your door to your office and brood over your homegrown set of QuickBooks and Excel files.

The blood pressure rises as you sift through the uncategorized transactions, re-litigating every single spending decision you’ve made over the past week.

The team knows when it’s happening… and for a few hours they’re walking on eggshells.

But it’s gotta be done.

And unless you’re one of the anomalies coming from the accounting world, it’s whatever you can manage, paired with some back-of-the-envelope voodoo math you can use to attempt to determine whether you’re making money on this or that SKU…

In other words, it’s enough to get by.

And this is totally okay…

At first.

But at some point it starts to hold you back.

We’ll be walking through what we see when we open up the books of a typical brewery for the very first time.

A warning: It’s not pretty.

But you already knew that.

So what’s the very first thing we notice?

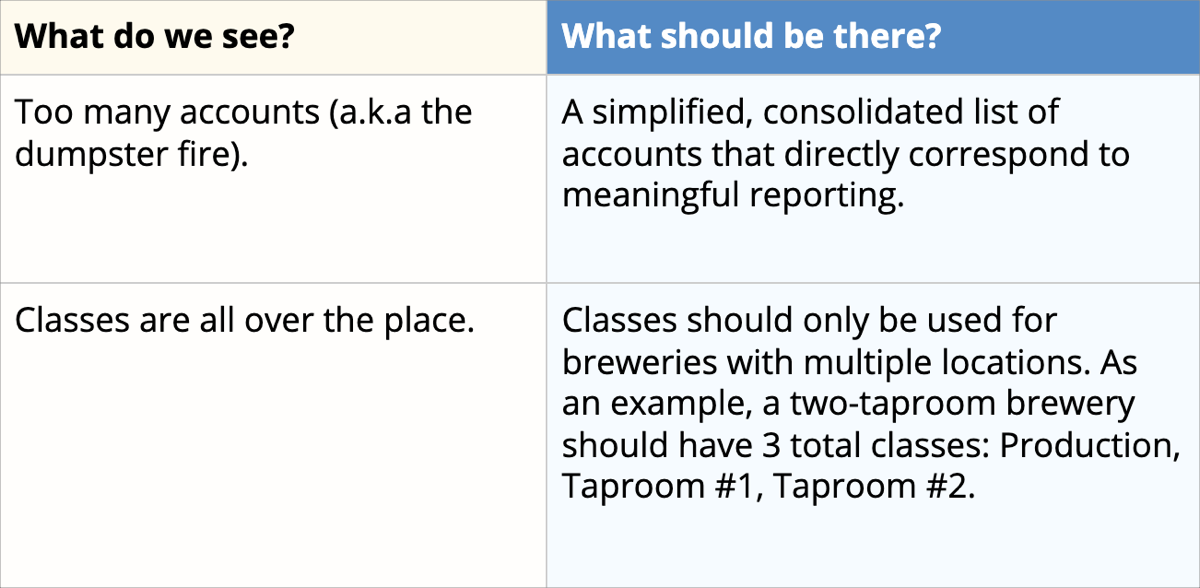

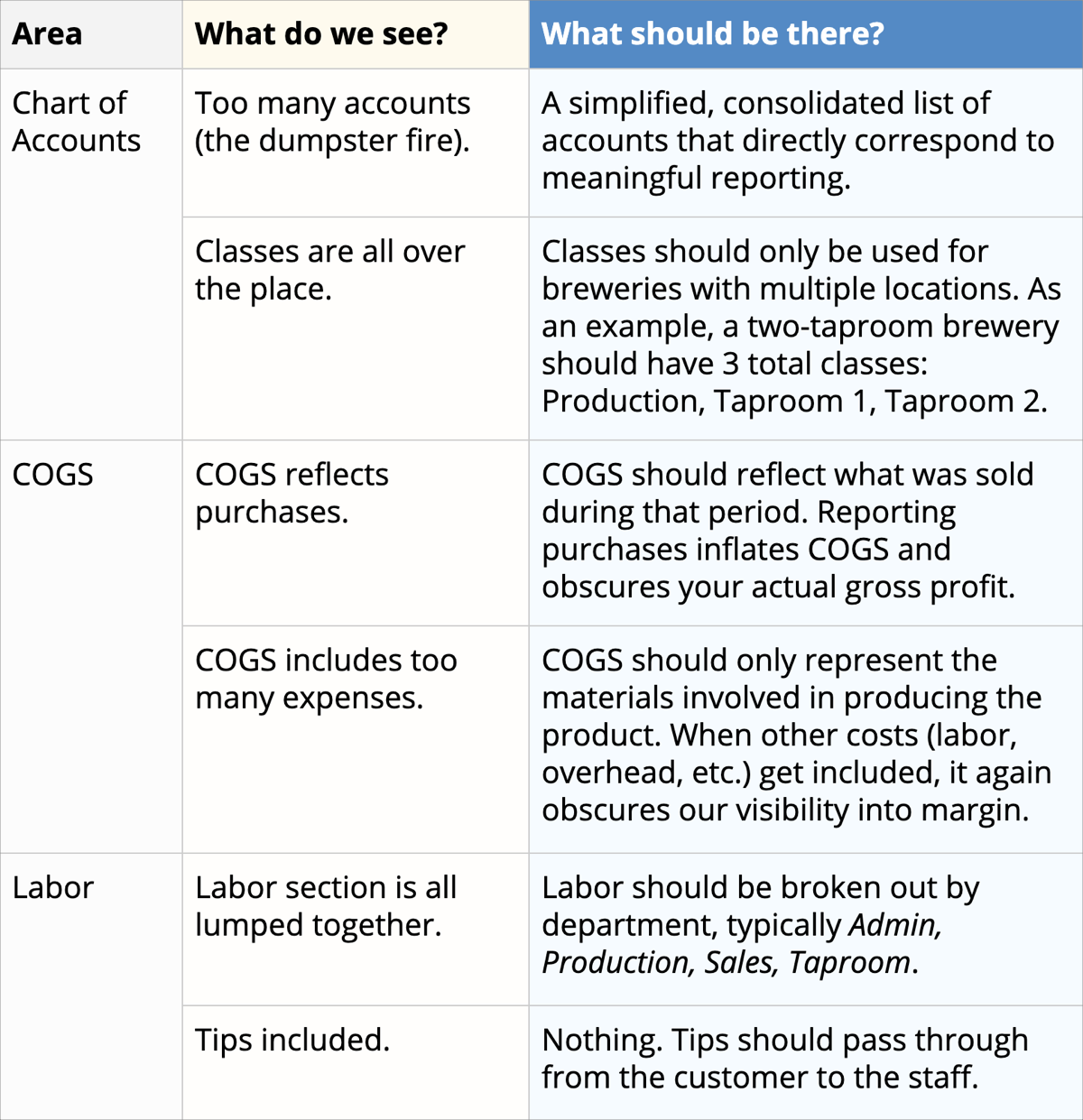

The Dumpster Fire: A Typical Chart of Accounts

Yes, how lame…

I’m well aware that talking about your Chart of Accounts is the equivalent of a CPA justifying their own existence.

So LOL away, until you realize that the COA is not an academic exercise in grouping your income and expenses:

The real use of the COA is how your financials are reported.

And those “reports” are not only the key to convincing your investors that yes, indeed, they should fund that next expansion project… but also contain the most powerful, intelligent-decision-making information available to you.

What do we see?

A complete dumpster fire.

On one end of the spectrum the unlucky soul who’s been put in charge of loading up the transactions in QuickBooks has gone trigger happy and generated new categories like a group of rabbits on a carrot farm…

They have also taken the liberty of assigning classes, and turned it into Accounting Bizarro World, classing everything left and right.

What started as just a few special designations here and there, has now multiplied into an unmanageable cluster-F.

Good luck untangling that spaghetti bowl.

On the other end of the spectrum, it’s a desert wasteland… with taproom glassware hitting Advertising, throwing off any hopes of using metrics…

And large globs of expenses hitting General and Administrative, and zero visibility on the P&L other than, “Are we losing money?”

I see this all the time.

What should be there?

Instead of the wild spaghetti bowl of well-meaning but out of control detail, we need a consolidated chart of key accounts that will enable us to view the P&L as a decision-making tool.

At the same time, the organizational underachievers need to step up the discipline and use that same consolidated approach to achieve the same aim: enough detail to extract useful information… without going overboard.

Getting this balance right doesn’t seem like much but makes all the difference when you go to interpret the data.

Side bonus: we get to use the native QuickBooks reporting without having to do analytical backflips to get the right numbers out at tax time.

What are the implications?

When the Chart of Accounts is disorganized, one of two things happen:

- The extreme level of administrative overhead starts to feel like a government bureaucracy. We’ve seen breweries that have created entirely unnecessary full-time jobs for themselves simply through creating this level of unneeded complexity in their COA.

- The lack of visibility kicks off the generation of a new type of spaghetti bowl: a wide selection of Rogue Spreadsheets created to try to figure out what the hell is going on. Also unsustainable and usually back-asswards. Then back to “the gut” it is on those key decisions.

Put simply:

Good COA = good information.

Bad COA = bad information.

Most breweries are getting bad information.

And we all know what happens when we make decisions on bad information…

Which leads us into our next topic.

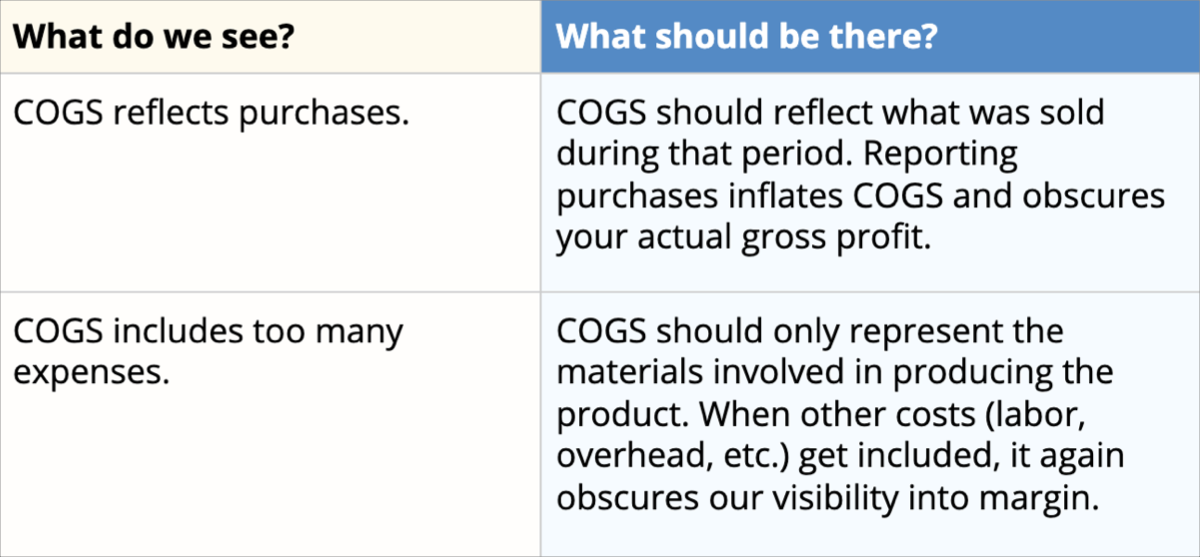

COGS: The Fudge Factor

Guess and check.

That was my favorite math class activity.

The rush of trying to figure out the answer to a problem via faulty kid logic, holding out hope that somehow you could game the system…

Only to get your exam back and realize (a) just how insanely far off you were.

And (b) just how easy it WOULD have been to get the correct answer and avoid the panic, frustration, and mental gymnastics it took to come to the entirely wrong answer anyway… had you spent just 5 minutes looking at the correct approach.

This is exactly the relationship the typical brewery finds itself in with their approach to Cost of Goods Sold.

Fudging their way into an incorrect answer.

What do we see?

Cost of Goods Sold (COGS) is exactly that… the costs that go into actually producing your liquid.

This is where the dumpster fire we just talked about obstructs most breweries from coming anywhere close to the right answers.

And the right answers do, in fact, matter.

Because in the typical brewery, questions like:

Are our packaged product sales profitable?

Should we sign this distribution deal?

Should we increase capacity and distribute or build out another taproom and maximize our local market?Should we contract brew or should we do it in house?

Are entirely unanswerable without a systematic approach to recording COGS. Hence, most brewery owners DON’T HAVE good answers to these questions.

And as you’ve heard me spout off before: that’s amateur hour.

What should be there?

Instead, the few and far between breweries who get this right, have a disciplined approach to generating an accurate COGS number for every single one of their products sold…

And it’s not complicated.

The breweries who do this right have:

- A clean Chart of Accounts.

- Their Ekos sync properly configured.

- Proper inventory management processes in place.

- Accountability and process for entering ingredients, recipes, and production orders into the software correctly.

- Their POS configured to categorize sales appropriately.

Simple but not easy…

Because like the grade school math test, it’s all about following some straightforward rules.

And most kids don’t like rules.

What are the implications?

When owners and operators don’t have this information…

It’s again to the gut we go:

- Determine gross profit across your product portfolio? Forget it.

- How much will COGS decrease as we increase distribution volume? Off to the Rogue Spreadsheet.

- How do the contract brew quotes we’re getting back compare to COGS? 50/50 shot of making the wrong decision.

And this is where we find the typical brewery. Making the decisions based on their best judgment, but effectively blind.

While well meaning, this approach puts most in the position of having to course-correct after signing an unsavory distribution deal, purchasing unnecessary equipment, or just simple analysis paralysis… unwilling to make that one tough decision that moves the business forward for fear of making the wrong move.

All of these problems are solved with good, accurate information.

And that good information comes from following a few simple rules.

This is what we mean by financial discipline.

Speaking of financial discipline…

The Labor Lump

If there’s one area of the typical brewery that’s even more obscured than COGS, it’s labor.

This section needs to be handled with kid gloves.

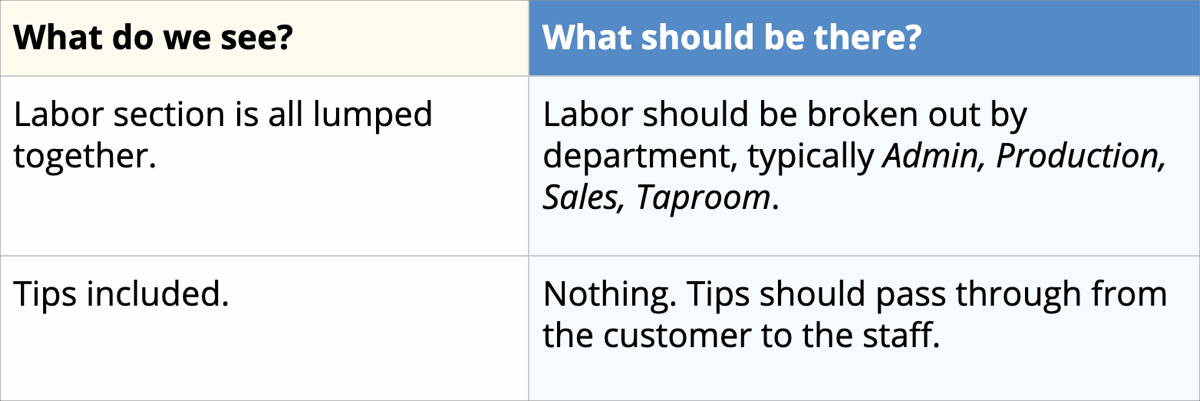

What do we see?

The typical brewery uses a 3rd party to run payroll. This is fine.

How the information is getting into the financials is not…

First Issue: departments.

As in, they don’t have any.

Most breweries do not break their team into departments and simply lump all wages (and sometimes taxes) into one line item on the income statement.

Second Issue: tips.

As in, most breweries ignore them.

Others lump them in as wages. Both approaches give us the wrong information.

What should be there?

Most payroll software allows you to set up departments. And they have those for a reason…

In (again the few) breweries who have this buttoned down, we expect to see: Admin, Sales, Taproom, Production. If you have a kitchen you will need more departments. Set it up and add those same accounts.

And on the tip thing…

When handled correctly, tips are a pass-through from the customer to the staff. In most cases they are held as a liability until paid. They should never touch the labor account.

Now is about the time you ask, “So what?”

Here’s the “what.”

What are the implications?

When your accounts are set up properly and labor is being accrued… wow, we can be dangerous with the advice.

It’s one of the many sharp tools we have.

When this happens, answering questions like:

Are we appropriately staffed in the taproom?

Are our sales reps pulling their weight?

Should we have a full-time admin at our size?

Can we handle hiring another Cellerman to support production?

Is a quick, easy, and accurate exercise… A simple look at the P&L, a few numbers pushed around in a spreadsheet, and an answer pops out the other end.

This is not common.

And as a result the org chart for the typical brewery ends up heavily weighted toward wherever friends, family, or the favorite function of the ownership places their emphasis.

Hiring decisions go something like this:

And this lack of visibility often produces a cascade of inappropriate hiring decisions that have to then be adjusted, reversed, or just simply dealt with once the brewery gets it’s bearings after the fact.

Plus, we haven’t even addressed the nightmare we avoid when it comes to payroll taxes and other compliance items like little old Mr. PPP forgiveness application.

Appropriately categorized labor removes the guessing game.

And less guessing means better performance.

The Finance Wrap Up

When we ask brewery owners about what matters to them most when they first come to us for help…

Much of it can be summarized in one word:

Clarity.

Specifically, financial clarity.

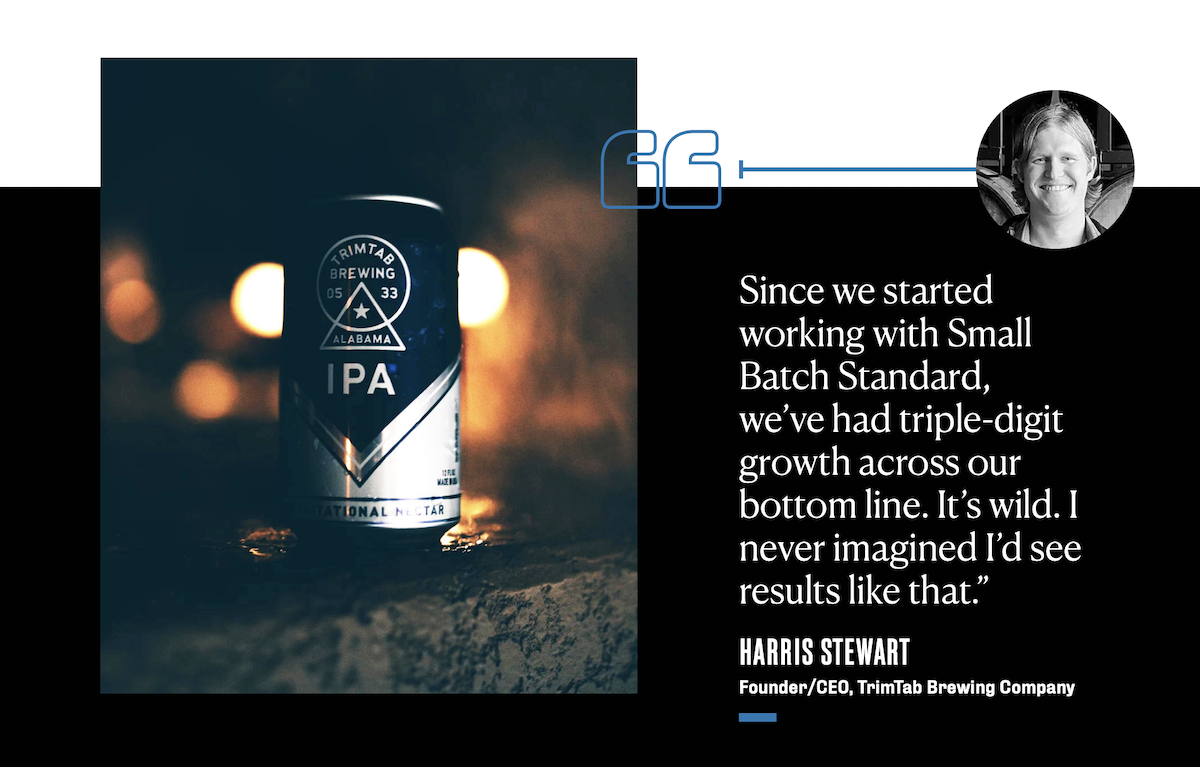

Which is exactly what we help our clients, like TrimTab Brewing achieve.

(More on them in a minute.)

Here are some direct quotes we’ve heard from other owners looking to make moves in this area:

“We would like to have our bookkeeping and accounting handled by a professional. We need a more cohesive inventory and cost of goods model.”

“Remove debt, build traction, standardize practices, and increase cash flow.”

“I would orient our business financially to better track profitability across each of our taprooms.”

“I need industry specific cost analysis tools and my back office accounting set up to replace the home made Excel spreadsheets I created.”

“Reduce the cash flow roller coaster.”

“A clearer financial forecast.”

Now of course, as much as I like to pretend that I do, no one has a crystal ball.

When we take the numbers, proper financial accounting, and combine them with the future, our creative thinking and knowledge of what’s coming next…

The result is our best guide towards a successful outcome.

It’s why, when COVID hit, we placed such an emphasis developing a clear forecast on cash flow, and a clear forecast on the mechanics of the packaged to-go business model we needed to pivot to.

Let’s recap what we see in a typical brewery:

Taken individually, each one of these issues are a problem to be solved.

But taken together and they start to obscure our view and make it difficult to see what is up ahead.

To take time away from the important things: brewing delicious beer, building an incredible team and culture, keeping your eye on the horizon for threats and opportunities.

What we see when we open up the books of the typical brewery is…

Well it’s the reason we exist.

Because starting, running, and growing a brewery is hard enough.

So our job is to augment and enable the potential of the brewery that’s already there, dormant, ready to be released.

And working with TrimTab, we did just that.

The Atypical Brewery: TrimTab’s Financial Clarity

What we’ve covered this week is just the tip of the iceberg of what’s available to the brewery that decides to take control of their financial function and engineer discipline into their organization.

And no one knows this better than Harris and his team at TrimTab, who have placed themselves squarely in a “Head of the Class” leadership position out of Birmingham.

The liquid, the growth, the profit, the community and culture, the legacy, it’s all there.

And that’s exactly the objective our Numbers Powered Growth service is built to help breweries like theirs achieve.

But that only happened as a result of their decision to take control of their numbers, and develop a clear view of the financial path forward.

“We needed to improve our cash flow, starting with a complete set of solid, month to month financials. We could only run the company as well as we knew our numbers.”

And that decision kicked off the step-by-step process we’ve designed specifically, exclusively for this purpose.

Read the full TrimTab case study >>>

Through that process, we systematically tackled each aspect of the back office (much like the areas we’ve discussed this week), offloading their team, handling compliance, and organizing their financials…

From there, we used that framework to feed the most valuable information about the business back to Harris and his leadership team to make the intelligent, informed decisions that would ultimately lead to the position they find themselves in today:

“We went from a company that didn’t know if it could be self-sustaining, to having best-in-class operating earnings. Small Batch helped us understand that it’s not just about selling more beer; it’s about selling the right beer at the right price with the right expense structure….

Chris and Small Batch Standard are the periscope to our future, a sounding board for the present, and a microscope on our past. They know where we want to go, and how to get us there.”

TrimTab is leading the industry from a position of strength.

And we’re privileged to be a part of their journey.

Next Steps

Now you might decide that this is the path you want to pursue as well.

It’s certainly not the “typical” path.

But who wants to be typical?

It’s a path you can pursue on your own…

And that may well be your best bet. Whatever takeaways you’ve gotten from this week, we hope they’ve helped to illuminate what those next steps might be.

But if you’re like Harris and you’re ready to take that next step with our help, I encourage you to schedule a call with us.

It’s not a pitch. It’s a conversation: a short call to determine if we’re a good fit.

Sometimes it’s not, and we’ll turn you away if we don’t think it’s worth your while.

But if there’s anything I’ve learned over the past decade of entrepreneurship… it’s that the times of change and uncertainty provide the best opportunities for a new trajectory.

Now is one of those times.

So let’s get a call on the calendar to find out >>>

And next, we shift our focus to the taproom.