A few weeks back, we explored some initial thoughts on the new Package Store model that has emerged as a result of the corona-shutdown.

Then we dug a bit further into the financial implications that this newfound emphasis on packaged product sales would have both during and after the crisis.

And now most recently, we’ve circled back to determine how much of that speculation has, and will continue to come to fruition.

Are packaged sales replacing taproom revenue?

Will they continue as a significant portion of future revenue?

Of the breweries that have successfully replaced taproom revenue with packaged sales, what have they done differently than those who haven’t… and what can we learn from them?

Those are the key questions we aimed to answer when we rolled out this survey. And 49 responses later, we have some initial conclusions to share.

For context, while this may not exactly represent the craft market at large it does represent a sample from the group of 900+ individuals subscribed to our email list who listen to me spout off on a weekly, sometimes daily, basis.

So interpret that how you will…

Regardless, the findings are instructive and add some hard data into the mix.

Let’s dig in.

Conclusion 1: Some, not all, taproom revenue has been replaced by packaged sales

Most breweries have been able to replace some, but not all, of their taproom revenue through packaged to-go sales (82%). Some have almost matched (8%) or even exceeded (10%) their previous taproom sales.

Further, it’s interesting to note the annual production volume distribution as well. Higher-volume breweries (5,000 BBL and up) have not replaced as much of their taproom revenue, while smaller breweries (less than 1,000 BBL) have had more success in doing so.

Why is this the case?

Judging by the decision-making we’ve seen with our clients, it’s likely these larger, more well-established breweries decided to focus on preserving distribution and holding out for the recovery vs. pivoting as aggressively into packaged sales.

On the other end of the scale, out of both necessity and nimble decision-making, smaller taproom-heavy breweries were likely able to more rapidly transition their marketing and operations to support the massive shift in market conditions. Although, as you can see, many in this category weren’t able to replace that income.

More on this to come.

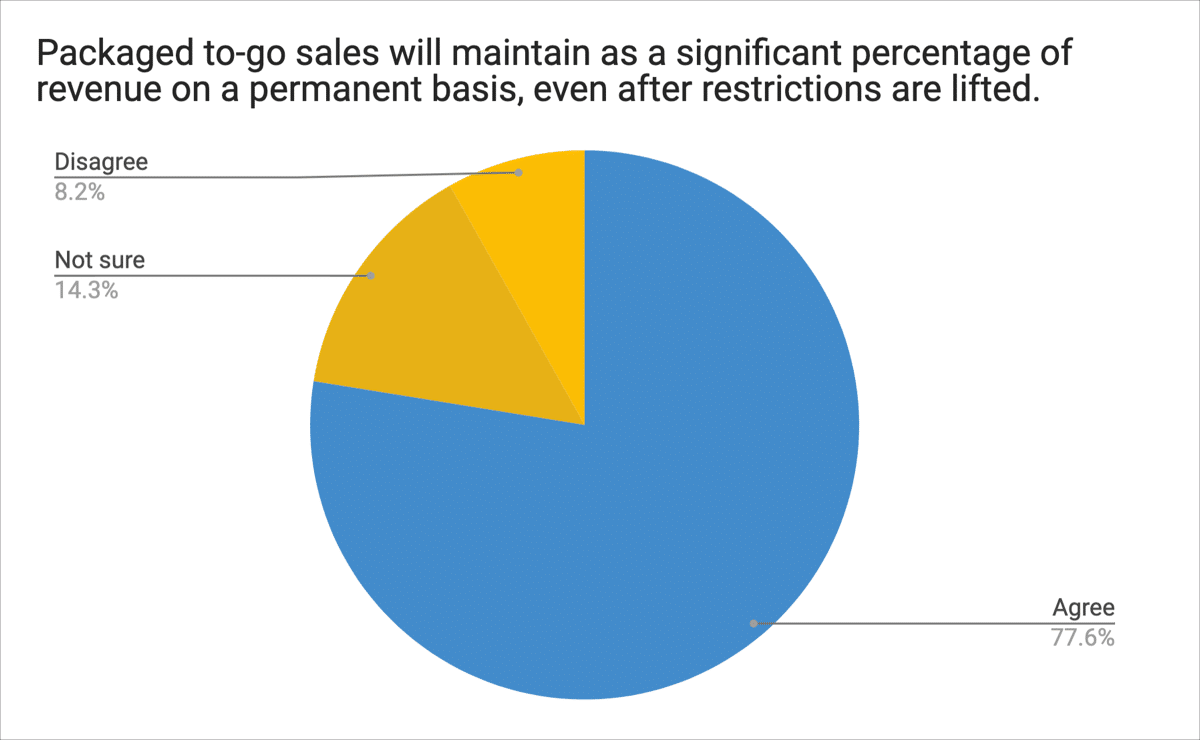

Conclusion 2: Most breweries believe packaged sales are here to stay

Most breweries (78%) believe packaged to-go sales will maintain as a significant percentage of revenue on a permanent basis, even after restrictions are lifted. Some (14%) aren’t sure and a few (8%) disagree.

What’s interesting here is:

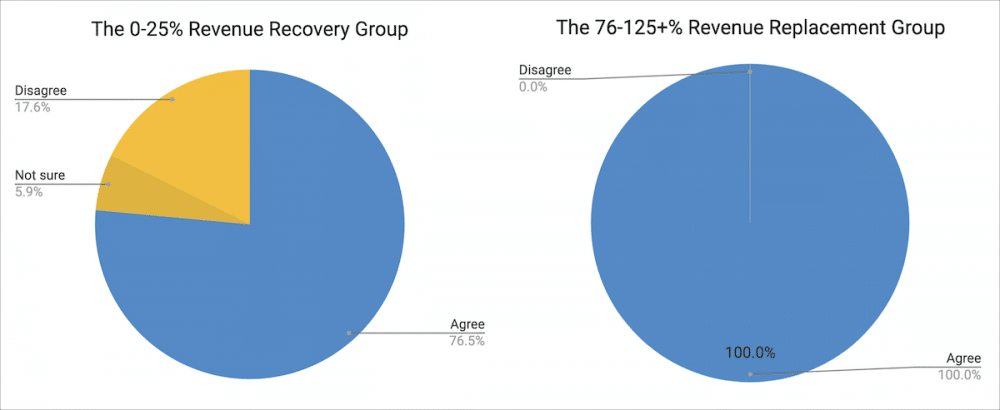

All of the “disagree” responses fell in the 0-25% revenue recovery bucket…

While all of the breweries who have replaced more than 75% of their revenue agree that packaged sales will persist, even after restrictions are lifted.

Two scenarios we see here:

- Scenario 1: The breweries who have had success with packaged sales are encouraged by their performance so far, and intend to keep the good times rolling. The opposite is true for those who have only been able to recoup up to 25% of previous sales.

- Scenario 2: The breweries that did not believe packaged sales would represent a significant portion of revenue didn’t pivot and commit as significantly, and underperformed as a result.

I think it’s probably a combination of the two.

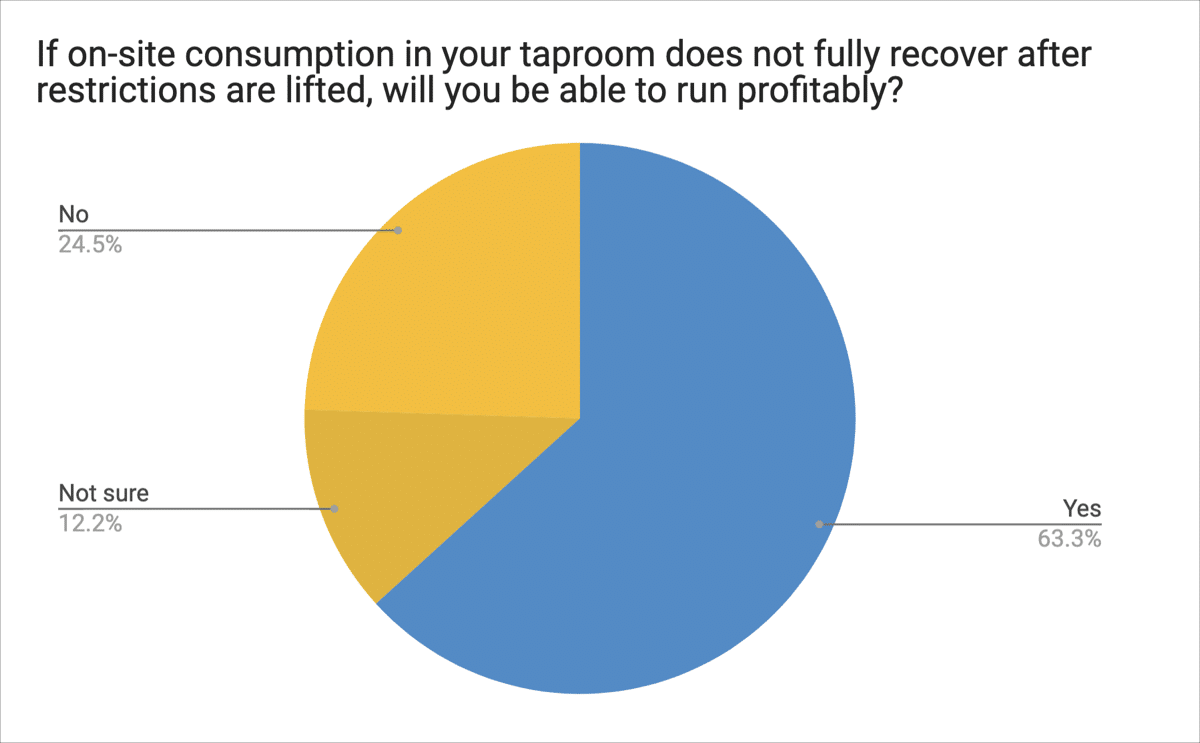

Conclusion 3: Most breweries will be able to run profitably, even without full recovery

Most breweries (63%) believe they’ll be able to run profitably under this new setup, while 12% aren’t sure and 25% say they won’t.

To us, this indicates that while most breweries believe The Package Store model will be a permanent revenue source moving forward…

There’s still some uncertainty around how to best make this new model work long term.

A few comments from survey respondents that illustrate this point:

Sales are slowing as people feel confident that their local brewery is not going out of business. Mentality has shifted from “gotta support and keep these guys going” to “let’s see if they have anything interesting on tap, or anything on sale…”

“Package Store” / to-go has helped make up for on-site Taproom purchases. But it doesn’t make up for lost private event income. It also doesn’t come CLOSE to touching what 200-300 bars and restaurants around the city were doing for us in keg revenue. Kegs are higher margin than package… We are not seeing consumers buy the equivalent in package in the off-premise to make up for it.

No doubt, this is a multi-factor problem to solve and the market conditions continue to change.

With that said, there are some key levers we believe we can pull to increase the probability of success here… and that’s what we’ll cover next.

So now the big question: What’s the difference between the breweries who have successfully replaced taproom revenue and those who haven’t, and what can we learn from them?

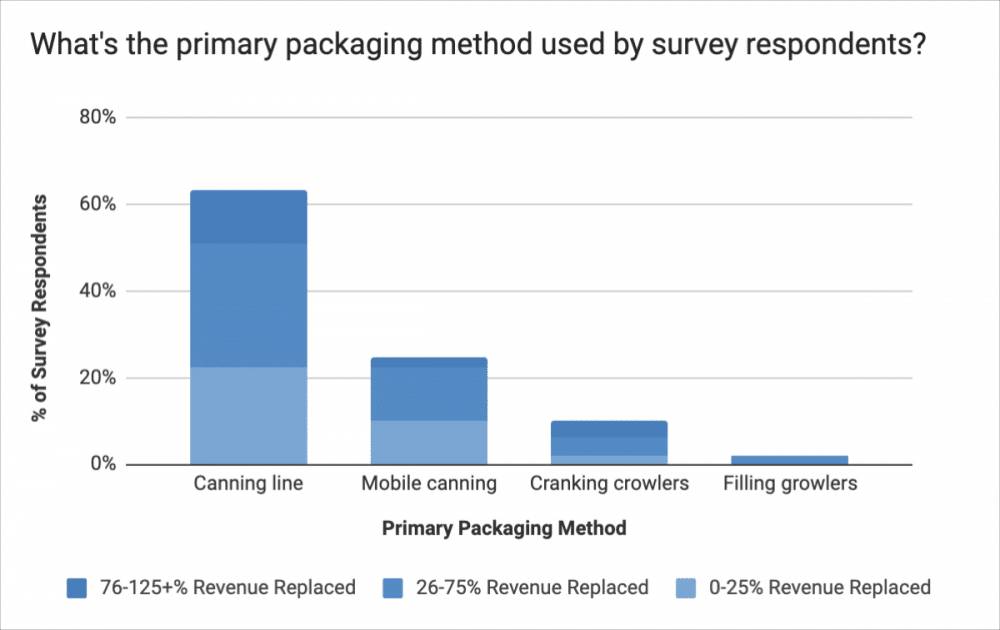

Conclusion 4: Capacity and packaging constraints have not limited taproom revenue replacement

Most breweries surveyed have a canning line (63%) or access to mobile canning (24%), while a few only have the ability to produce crowlers (10%) and growlers (2%).

Regardless, production capacity and packaging capability do not seem to have had a significant impact on whether or not breweries have been able to replace taproom revenue.

In fact, a significant number of the > 100% revenue replacement breweries don’t have access to canning (i.e. just crowlers)… which to us indicates that the canned product in and of itself is not the main driver of success with this model.

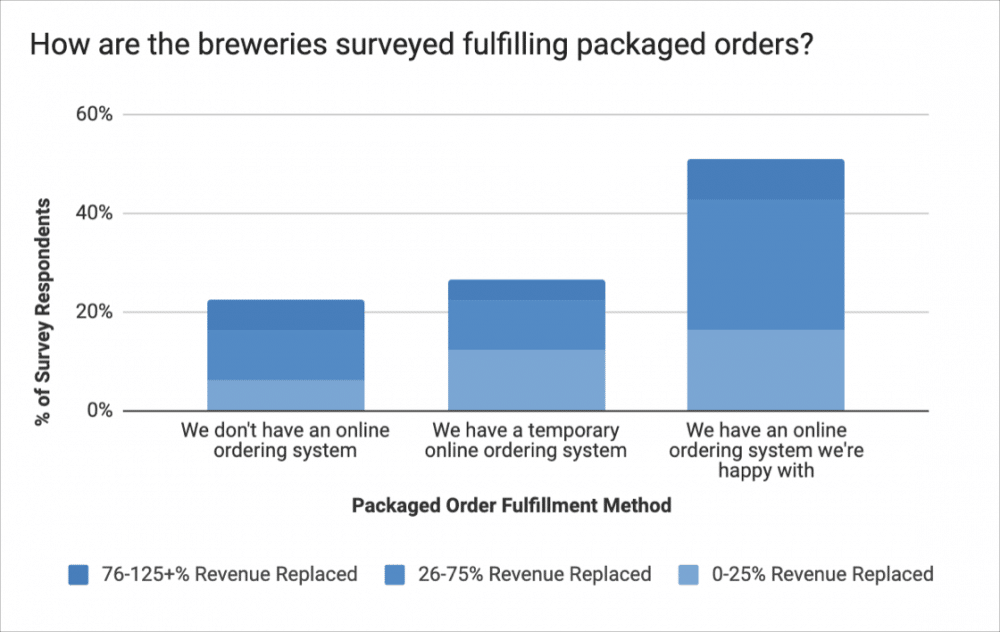

Conclusion 5: Most breweries have an online ordering system they’re happy with

A little over half (51%) of the breweries surveyed have an online ordering system they’re happy with with another 27% of breweries who have a temporary online ordering system. About a quarter (22%) of breweries don’t have an online ordering system.

Interestingly, again there were no significant differences between the high revenue replacement and low revenue replacement groups in this regard… and a few of the top performers surveyed noted they are taking orders either by phone or in person.

However, keep in mind that this is a self-reported metric that doesn’t answer the true question we’re all interested in: How effective (objectively) is your online ordering system?

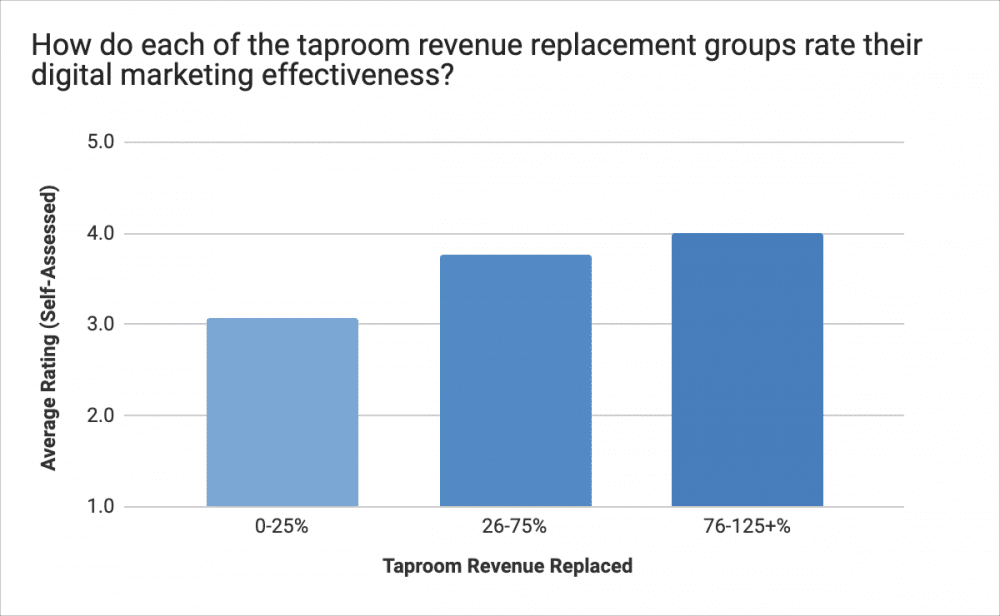

Conclusion 6: Digital marketing effectiveness is a significant driver of packaged to-go sales

The third question we asked here was: How would you rate your digital marketing effectiveness (on a scale of 1-Poor to 5-Excellent)?

Where effectiveness means the ability to generate tangible business via email, SMS, Facebook, Instagram, etc. Essentially: “How good is your brewery at generating orders through direct-to-consumer marketing?”

And here we see a trend.

The breweries that have most successfully replaced lost taproom revenue via packaged sales rate themselves higher in digital marketing effectiveness (4.0 on average) than those who have been least successful (3.1 on average).

Now again, this is self-assessed so take this with a grain of salt. Things we couldn’t evaluate:

- What’s the actual effectiveness of their digital marketing efforts?

- How much total audience reach (followers, email subscribers) do they have?

- How much brand equity (trust, good will, and attention) have they built up over time with their audience?

So although we think those questions reveal the true drivers of success in generating to-go orders online, the self-reporting trend is telling…

And it’s clear that direct-to-consumer digital marketing capabilities have a big impact on success under this model.

Leaning In Hard: A full packaged conversion

Taken to its logical conclusion, the full implementation of this shift requires skilled execution of all of the factors we’ve covered up until now:

- The belief that packaged sales will persist, and that the brewery can run profitably under those conditions.

- The on-demand packaged production capability.

- The seamless, user-friendly order fulfillment system.

- The high-level brand-building skill set and digital marketing execution ability.

Our friends over at Brew Gentleman have done exactly that to great effect… and are on the leading edge of what’s possible with this new type of craft consumer experience.

One of the best initial examples of a rapid pivot at the beginning of the crisis back in March…

And now continuing forward as a prime example of what it looks like when you lean into opportunity as the market changes beneath us…

We highlight their work not to say that it’s right for everyone, but as a beacon of what’s possible under this new model.

Okay, let’s wrap up.

Future Adjustments: What’s on the horizon for the breweries surveyed?

Finally, to gain some additional perspective on what’s out there for next steps… we asked what other adjustments breweries focused on continuing to drive packaged sales were planning to make.

Here’s what a few of them had to say:

Buying a canning line.

Sourcing cheaper cans.

New POS and online store, pickup options. Delivery options hampered by distributor. Formulating additional packaging combos and assets.

Many, many more 16 oz can releases (from 4-6/month to 12-16/month). Two separate stations for on-premise sales and off-premise sales.

We collaborate with food trucks every week for “take and bake” meals and crowler “cocktails” that compliment them. We also do Farmer’s Market baskets for pick up every Saturday. So…I guess I’m saying that we have become a way for other businesses to piggyback on our location and online store to sell their products.

Reduced labor needs. Reduced hours. Shift away from live events. Focus on virtual events. Focus on shipping/delivery. More sophisticated digital marketing.

No duplication of draught vs. cans…it’s better if the cans are unique.

More variety of cans… people will buy one of each.

So now we’ll turn it over to you.

What actions are you taking right now?

Whether it’s shifting back into traditional taproom mode as you open back up… or whether it’s leaning further into the Package Store model.

Email us at chris@sbstandard.com. We’d love to chat.