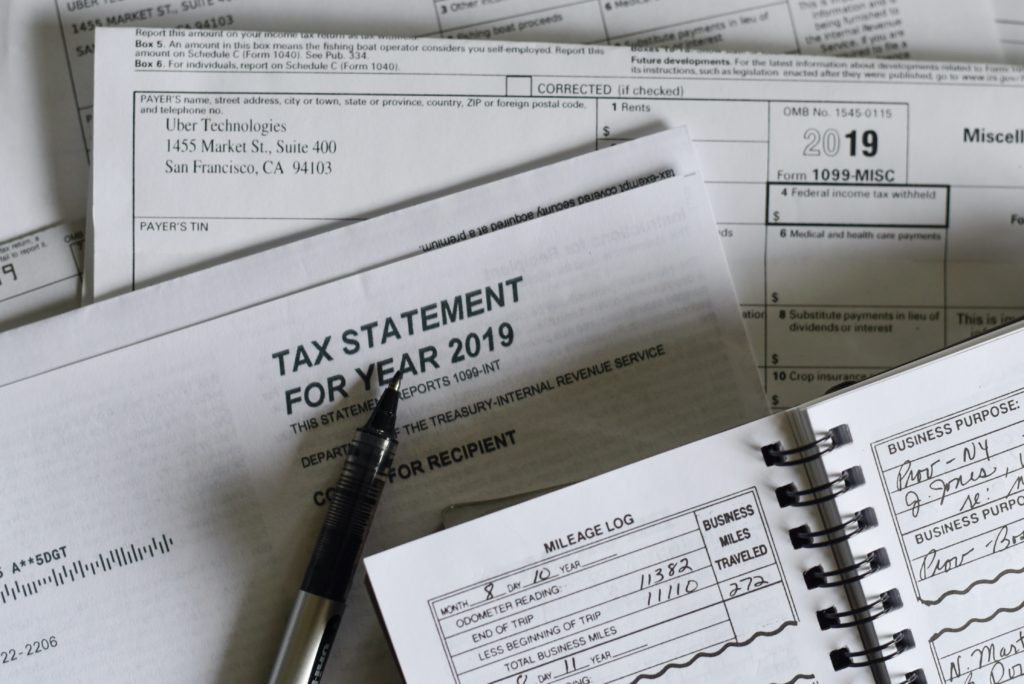

Well folks, It’s that time of the year again when we start planning for…

Tax time!

Arguably everyone’s favorite time of the year.

Said no one, ever.

Pardon the sarcasm. This will be the only tax post for the year, so bear with me.

The stance I take on taxes is, it is a form of wealth creation. The tax code, in its purest form, is a 2,600 page document which continually grows year after year.

Why do you think this is?

Let’s circle back to my theory of wealth creation. If the most powerful people in the world have a motivation to pay the least amount of taxes, they make shit happen. The less they pay, the more wealth they retain. As a result the tax code grows to fit their special interest.

Like it or not, it’s the way the world turns.

It is our job to understand which sections and paragraphs of this monstrous code affect your business.

Or in Chris’ language, how do we help create wealth for you and your partners?

Last week I joined my friend and colleague Kary Shumway on his podcast to discuss tips to make tax time go smoother.

Kary is the founder of Craft Brewery Financial Training, and is a wealth of knowledge when it comes to craft breweries and distribution.

Kary asked me straight up, “What can craft breweries do to prepare for the year end taxes?”

I’m glad he asked:

- Books and Records – This is the baseline. C’mon. Clean books make the tax process go smooth and give clarity to the CPA working on them.

- Demands – Demand a meeting with your tax person before year end to review a tax projection in attempt to avoid any surprises next April. SBS TIP: The giant ERC check you received last week is NOT FREE MONEY. Yes, you heard me correctly. The ERC refund will be taxable income to the business. From where I sit, this means hundreds of thousands of dollars dropping to the bottom line. Caveat, we are still waiting on guidance as to what year this will be taxable, but assume it will hit in 2021.

- Ownership Changes – Another birds eye view of what I am seeing… investors want out. They don’t see a viable return on their capital, so they want out. Makes sense. Most breweries are just fine supporting 1-2 families, but more than that and we have liquid stress. So, if you are ready to remove all/some of your investors, there are important steps you need to take to ensure everyone is protected:

- Get a valuation, I can help with this.

- Speak to your CPA about these changes before they happen. There could be tax upside or downside to the transaction

- This goes both ways, if you are planning on raising capital, the same suggestions apply.

- Tax Credits – I bring this up every year at this time and it’s worth mentioning because of the massive amount of savings. The two biggest credits available to breweries are:

- R&D – Make sure you are taking advantage of this credit. It is a meaningful savings and you are entitled to this benefit. This credit is foreign to most CPAs, which is why you receive many solicitations from companies who solely do this work.

- FICA Tip – This also could result in big bucks if you have a strong taproom. Most CPAs are aware of this one.

Obligatory tax post is coming to a close….zzzzz.

No questions are silly questions, so let us know.