Are you running a business or a hobby?

You might say:

“Of course I’m running a business. I have a tax ID. I have a building. I’m selling a product. I employ people. My business is 5 years old already.”

Turns out, it takes a little more to differentiate between a business and a hobby.

One of those things is making money.

I love to ski, but no one is paying me to do it.

In fact, because of my love for it, I spend hundreds (probably thousands…) of dollars a year on lift tickets, gear, and travel.

It is strictly a hobby.

If your business isn’t making money, you might have yourself a hobby too.

Sure, it might be a fun hobby. You might be making more beer than you did in your garage, and your taproom might have customers who say they love your product. You might have even won awards for your beer.

But, if you’re not making money (or at least well on your way to making money), it’s likely you’re in hobby territory. It does take time to get in the black, but we see many breweries become cash flow positive in as few as 8 months.

As it turns out, the second benchmark we look at with our clients, EBITDA, can help you figure that out: business or hobby.

Comparing To Our Benchmarks

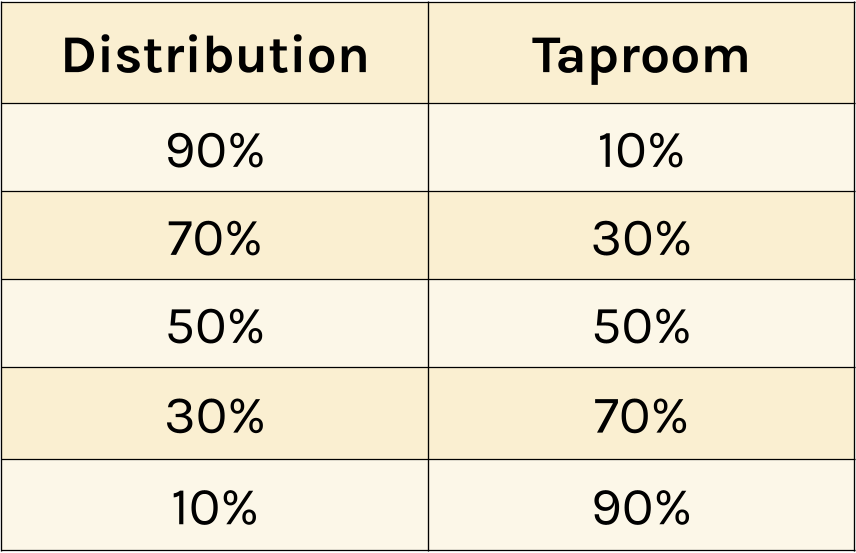

If you recall from the last email, our metrics are based on the brewery’s distribution/taproom revenue split.

We have 5 benchmark categories:

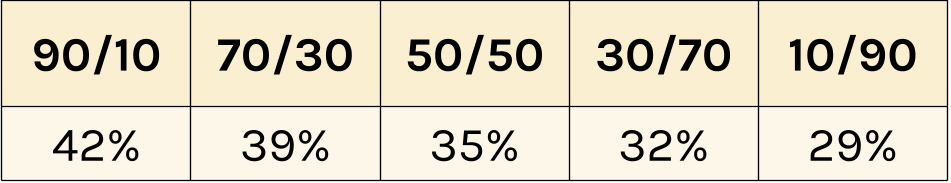

When comparing EBITDA to Gross Income, our benchmarks look like this:

Do this:

- Run a P&L for last year.

- Find your Net Operating Income (bottom of the report, before Other Income, Other Expenses, Net Income)

- Divide this number by the Gross Income

How do you compare to our recommendations, based on your distro/taproom split?

If your EBITDA is in the red (negative Net Operating Income), why is that? Was that part of the plan, or an unintentional side effect?

If you’ve already qualified as a “business” (positive EBITDA), are you making as much as you could? If not, what’s going on?

One place to start, as we covered last time, could be your COGS. Think about where you land given our COGS recommendations.

If this is good, what other issues are driving down your Net Operating Income?

Is your labor cost too high?

How about occupancy?

Is your general spending out of control, and do you need tighter reins for those on your team making purchases?

Dig in and see what you find.

Looking Forward

Now, learning from the past is essential, but change only happens when we shift our focus to the future. So with that in mind, here are some things to think about and plan your future around:

- Focus on increasing distribution revenue by considering adjustments to your distribution pricing, portfolio, and terms. More distribution tips can be found here.

- Focus on increasing taproom revenue through strategic price increases. Additional taproom tips can be found here.

- Get your labor in range, either through increasing revenue or decreasing headcount/hours

- Maximize your merchandise income (100% markup!)

- Create a budget and hold your team accountable to it.

- Renegotiate insurance or occupancy.

- Limit general expenses and find where you can trim the fat.

Make the changes you need to steer your brewery into positive earnings. Sure, that’s easier said than done, but you didn’t get into this business for “easy” did you?

You love beer and your love of it probably helped you open your business and gave you early success.

But if you’re not mindful of your profitability, your business just might have turned into a hobby again.

And that’s not where you want to be.

One more ski pic for good measure.

-Derek