Do you know the cost of your beer?

Do you spend evenings tinkering with a multi-tab, multi-thousand cell costing spreadsheet you made, where you think you’ve added in all possible ingredients, trying to nail down exactly how much money you’ll make on your beer?

And do these numbers not jive with what’s happening in reality?

What is the true cost of your beer?

In working with a wide range of breweries across the country, we have developed benchmarks, some of which I’ll be covering in the next several emails you get from me.

The metric at the very top of our list is COGS.

As you know, it’s important because it tells you how much you have left over to run your business after you’ve made and sold your product.

How much you can spend on rent.

What you can spend on labor.

What you can spend on a new piece of software, or an office chair, or whatever.

This is all ONLY after you have determined how much it costs you to sell your beer.

The Metrics

Our metrics are based on your brewery’s distribution vs. taproom revenue split.

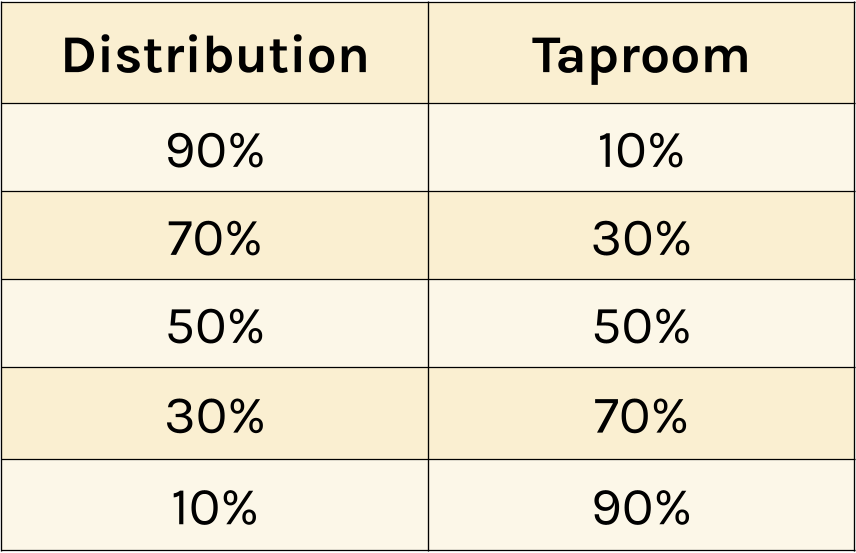

We have 5 categories:

And for each split we have a different set of benchmarks.

For example, we all know the taproom to be the most profitable income source, so when we’re analyzing a 10/90 brewery (90% taproom), our target for EBITDA is 15%, versus a 90/10 brewery (90% distro), EBITDA is 3%. There is just less money in distribution.

So, if you’re with me so far, let’s dive a little deeper into COGS.

How We Define COGS

There are multiple opinions on what should be included in COGS, but for our purposes, we define COGS as:

- Anything that touches the beer, hopefully coming from your brewery management software (malt, hops, packaging, etc.)

- Brewery supplies (sometimes yeast, adjunct ingredients, things not worth putting in your software)

- Merchant Account Fees

- Excise Taxes

- Freight (especially for DTC)

- Keg Leases

Some breweries include production labor and utilities. We take those into account during other analyses, but for our COGS benchmarking goals, we don’t.

Your COGS should always follow your income. So, if your income goes up, COGS goes up, and vice versa. If you look at your system and this isn’t happening, something needs to be addressed.

This is often the result of bad inventory tracking or recognizing income in the wrong period.

For instance, if you bring in $100k in income, COGS should be around $32k. If you have a month where you make $100k and your COGS is at $60k, you may have a problem with the way your inventory is being accounted for.

This also rings true if your income was at $100k and your COGS was $10k. Again, you have accounting issues.

Changing Metrics

While we update these numbers periodically, the last year and a half has changed our view on our target ranges for COGS.

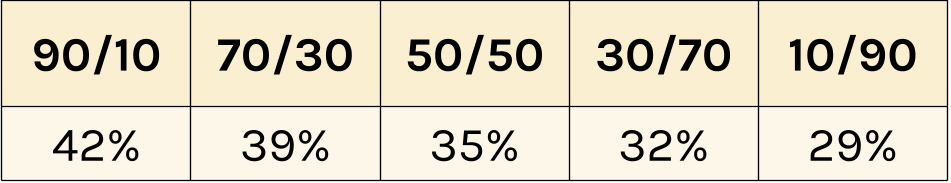

Our metric for Cost of Goods Sold pre-2020 was between 21-28%.

Historically, this is where COGS had to be to hit the target EBITDA range we established for each of our benchmarking categories.

But we had breweries coming into our system who displayed COGS rates well above our benchmarks, while still hitting the EBITDA targets.

So, we dove in. And our metrics changed.

Analyzing our client stack we found that no one could hit those numbers anymore.

Pricing for ingredients has increased and income has stayed flat. And so after analyzing our most recent data across a diverse set of breweries, our latest COGS benchmarks look like this:

We always have our clients start by focusing on COGS, as we rarely see breweries above these levels generating enough gross income to remain profitable.

As for the how. Here are some ideas:

- Get a brewery management software. If you’re still managing your brewery operations on Excel (or worse, by pen and paper), it’s time to move on. We recommend Ekos. Without this automation, it will be difficult to nail down your cost per batch, inventory at month end, etc.

- Pay attention to these numbers on a monthly basis. Look for spikes in COGS and once you see one, find out what happened.

- Reassess your pricing. Start at what it takes to brew a batch and work backwards to your income goal.

- Track waste and inefficiencies. Is your yield too small? Are you dumping beer? What’s happening in the brewing process?

- Work with your suppliers. Talk to multiple companies to find the best pricing.

- Next level – margin analysis by product. What beer is making you the most money and what’s dragging you down? Figure this out, then focus on your most profitable products.

COGS is a crucial element to understanding what’s happening in your brewery.

And if you work to gain a solid understanding of it, it will provide you with the information you need to make better decisions about where and how much you can spend moving forward.

-Derek