When I first saw these videos…

Not gonna lie, I kinda sh*t myself…

(Metaphorically of course.)

And it seems like most people in the comments section share a similar sentiment:

If you’re not familiar, these freaky, future-glimpsing videos come to us compliments of Boston Dynamics, a quaint little MIT spin-off that has quietly been developing such family-friendly DARPA-funded robots as WildCat and Big Dog:

Good luck sleeping tonight.

You’re welcome.

It’s moments like these that I truly appreciate the value of participating in the alcoholic beverage industry.

Holy heck where did I just take us?

…

…

Right.

Intelligence.

This wild tangent comes to you compliments of thinking about the theme of this series (which in case you missed it, is this concept of Intelligent Action).

So let me bring us back to Earth.

What is Intelligent Action

Here’s where this came from:

When you think of the word intelligence what comes to mind?

- Your SAT score?

- Ken Jennings and crew?

- Some Harvard academic in a leather-adorned office with a tweed jacket, pipe in their mouth, and a pompous attitude towards the middle of the country?

Or maybe like me: the algorithmic, killer-robot-style artificial intelligence that’s the thing of dystopian movies starring Will Smith.

Well…

Actually none of that.

Because while the Boston Dynamics robots are flashy, they aren’t actually “intelligent” in the sense that’s meaningful to us.

(And actually aren’t even what the A.I. alarmists like Elon Musk are all that worried about anyway).

So what are we talking about?

The intelligence in Intelligent Action is one of the core tools the leaders in craft have used to transform themselves from:

Just another startup livin’ on a prayer.

To…

A legitimate, profit-producing, vision-expanding business that provides its ownership, management, and employees with a clear path to sustained success.

This is NOT the intelligence that showed up on your SATs.

But it IS the intelligence that’s required in order to make consistent high-quality decisions that:

(a) Maximize the likelihood of success, and

(b) Minimize the risk of failure

In other words…

Intelligent Action gives you the ability to make any size business decision without second guessing yourself.

Wouldn’t this be marvelous?

Alright …

We’re still in “fluffy” territory with the concept right now.

Let’s get specific.

First, this applies to small decisions:

- Taproom hiring

- Production scheduling

- Software choices

- Day-to-day sales tactics

- Can release label design

- Purchasing limits

Second, this applies to big decisions:

- Bringing on new investors

- Building your leadership team

- Developing your distribution strategy

- Portfolio planning

- Investing in additional capacity

- Planning an expansion

We’re just barely scratching the surface here.

The point is this:

Small or big these are the decisions that, taken in aggregate, can make or break the trajectory of the brewery.

And Intelligent Action is the tool we can use to align good information, disciplined decision-making, and successful execution to ensure we stay on track.

What happens when you start to apply this necessary and essential tool?

That’s up next.

The Why Behind Intelligent Action

Earlier this month, the team here at SBS stepped away from the day-to-day to plan out the year ahead.

And one through-line from our planning session was:

How do we double-down on what’s working?

Following this thread, during one of our discussions a team member introduced me to Greg Mckeown’s Essentialism.

His contention?

By identifying the vital few areas of focus that drive success for the business, and aggressively eliminating everything else, you can create more, faster, and better forward progress.

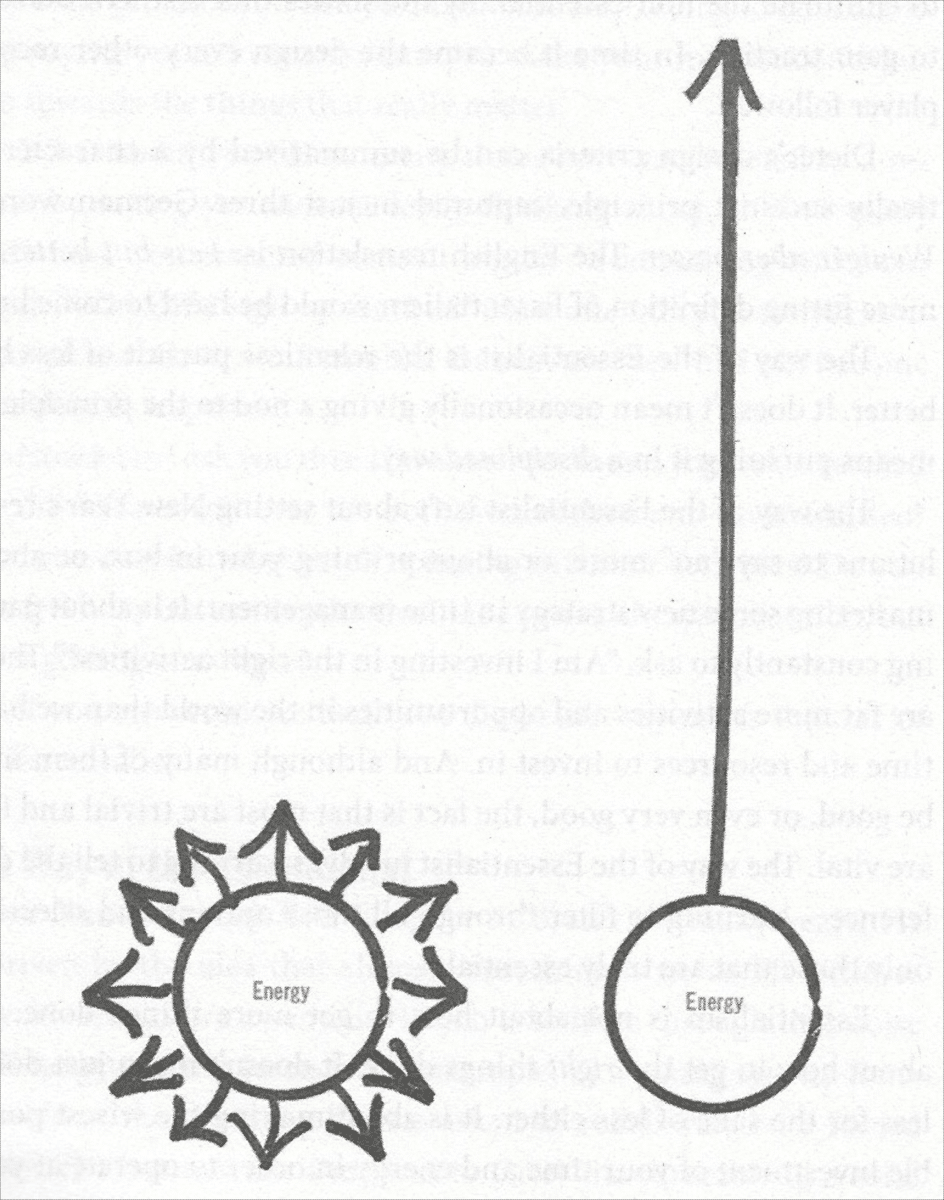

This image from the book is pretty wild…

One idea they explore that is particularly applicable to our current discussion is this:

Protect the asset.

And actually I’d like to put my spin on that:

Protect AND GROW the asset.

(Growth is essential for us to feel like we’re making progress.)

Now, there are two ways to interpret this.

First, “the asset” in the most literal sense, would be the value of the business. Does the brewery have the ability to generate profit and stand the test of time? Will it support you and satisfy your ownership? Will it sustain a team? Will it be sellable down the road?

Second, “the asset” in the less literal sense is YOU (and the intent of the statement in the book). Your brain, your body, your well being. Everything that you need in order to do what you do best.

As McKeown puts it:

The best asset we have for making a contribution to the world is ourselves.

And look…

This touchy-feely management consulting woo-woo isn’t exactly my cup of tea. I’m guessing it probably isn’t yours either.

But you also have to respect its role in the life of the entrepreneur.

The success of the brewery not only depends on your drive, your vision, and your sacrifice…

It also depends on your ability to stay in the game. To be present both physically and mentally in peak condition, especially now that the level of competition has risen.

Intelligent Action is a discipline that accomplishes both of these objectives.

- It drives the trajectory of the brewery in the direction that is aligned with financial prudence as well as the long term vision of the ownership.

- It also reduces stress, builds confidence, and frees you up to do more of what you do best.

With each subsequent decision to:

Make THIS production hire…

Change THAT packaging process…

Invest in THOSE pieces of metal…

…the brewery becomes more profitable.

…and the brewery also supports what you and your family need in order to sustain day-to-day, week-to-week, month-to-month, year-to-year.

Alright.

Enough of the fuzzy-wuzzies.

Let’s get down to business with two explicit examples of Intelligent Action in practice.

Two Winning Examples of Intelligent Action

These are my happiest days…

When I get to talk about winning clients.

These are examples of breweries who are killing it on the back of… you guessed it… Intelligent Action.

And while I’m withholding their names for anonymity’s sake, please believe they are 100% certified, real-as-it-gets.

Let’s get into it.

Example #1: Doubling down on high profit beer

One of our clients contract brews two core beers.

Nothing special about it… except that this move frees up capacity at the brewery for specialty, HIGH PROFIT, beers which they have trouble keeping in stock.

The next big move on the horizon is a fierce expansion. And during the planning process, the big question was:

Do we plan to bring the contracted beers back in-house or leave them be?

On the one hand, we realized that bringing them back in house would drop 25% of those sales right to the BOTTOM LINE. Hard to argue with that.

But on the flip side, what’s the profit margin of the golden boys we cant keep in stock? What opportunity cost are we leaving on the table by tying up the new capacity?

Fast forward through the number crunching, we decided to:

- Keep the contracted brews going. An unconventional choice given the circumstances.

- Double down on the high profit beers while focusing on marketing those money-making gems to fill out the new expanded capacity.

The obvious choice left unexamined (bring the core beers back in-house) would have resulted in a decision that left significant money on the table.

And through a numbers-driven decision-making process we were able to uncover a new pocket of uncapitalized opportunity through a less conventional choice.

Example #2: Unlocking volume with the half

Another one of our clients is killing it with a single beer.

I mean their whole portfolio is great, no doubt. But they have one beer in particular which sells… let’s say really, reeeeeaaallllly well.

They offer this beer in 2 SKUs only: cases and sixtles.

Why?

They’re the most profitable. You just can’t get the same price differential putting the liquid in half barrels.

Okay so what’s the problem?

Well, now the chickens have come home to roost…

The on-premise accounts have had enough of the B.S. and are demanding the half. So we had to come up with an answer:

Do we offer the half and take the hit on margin?

Do we hold out and keep pushing the case and sixtle?

What else is on the table?

Surprise: We had to take it back to the numbers.

First, we figured out what the market would be willing to pay for this beer in a half barrel and determined what we needed our new margin to be. As anticipated, there was a gap we needed to make up.

After a lot of head scratching, pencil sharpening, and stress testing the assumptions, we came back around to determine:

- We’ll mark up the difference to customer experience. The on-premise accounts are very busy going through a lot of this product.

- A half barrel will make their job easier, increase volume, and keep the beer flowing. So even at the lower margin it will help us meet our growth goals for 2020.

The usual profit-driving rule of thumb (push the case and sixtle over the half barrel) ended up as a limiting constraint for this highly popular beer.

And what this shows is that sometimes the context of the situation turns a best practice on its head, and points us in the opposite direction.

It’s then our job to follow it.

Alright…

What’s next?

An expose’ of sorts.

Two breweries on the losing side of the Intelligent Action coin.

Two Losing Examples (Action… But Not So Intelligent)

These are my saddest days.

When I have to expose undisciplined breweries who, instead of acting intelligently, decided to fly by the seat of their pants.

And the winning we got to celebrate in the previous section turns into, well…

Now did they know they were operating on gut and not numbers?

Was it hubris?

Well, I have noticed a specific ownership profile when it comes to not so successful brewing operations…

But for now, I will avoid the character bashing and get right to the (again anonymous but unfortunately true) examples.

Example #1: The close-minded big miss

This is the story of a brewery opened in 2009.

They were first to market.

Hell, they were 5th in their region to open.

And with their early entry, this mother/son duo was setting their state on fire… until 2012 hit.

You must be thinking:

“2012!? Wasn’t that the beginning of the most recent rush we are in?”

Exactly.

When all of the writing was on the wall that it was time to make the move…

And this brewery had the opportunity to expand, take their region, and dominate…

They didn’t.

Why?

Well, let’s just say they must have gotten their hands on our Intelligent Action outline, and proceeded to do the direct opposite.

They…

- Didn’t analyze the potential of the opportunity and run the numbers.

- Didn’t pounce on markets which had zero craft beer.

- Didn’t listen to anyone.

- Didn’t respond to what the market was asking for.

- Didn’t… well, quite frankly they didn’t do anything right except open when they did.

Ugghh!

What a shame.

Fast forward to 2020, I think they are still open. Irrelevant as ever. Still pouring 2009 beers to the last few customers they have.

This is an example when total close-mindedness takes over, and motherly control goes awry.

Needless to say: don’t do this.

Example #2: Ignorance + expansion = disaster

My second example is the story of the brewery who expanded too fast, off of gut feel, and ended up closing.

We hear about them all of the time.

Well, this particular brewery had been contracting beer for many years and decided to open their own brewpub. It’s what everyone else was doing, so why not?

But herein lies the problem:

- Instead of careful consideration of the timing, impact, and risks involved in the expansion, the plan was not well thought out.

- Instead of balancing creative vision with financial prudence, the chef resisted building a menu to take costs into account and instead blew out the budget, going dogmatically local.

- Instead of maintaining objectivity, they plowed forward with their heads in the sand… all the way until the brand shuttered.

Sure, there was too much ego involved.

And sure, if at any point the ownership was willing to pull the ripcord on the chef’s antics and right the ship, they might have pulled through.

But the biggest lesson here is when expanding into an unknown area, every detail must be carefully considered and calculated.

And quite simply… because they blindly decided to go heavy on the local sourcing (which, by the way, I am NOT opposed to) and throw caution to the wind, the sheer weight of the food cost and kitchen labor was too much to overcome.

Again: don’t do this.

…

Now I know what you’re thinking.

Sitting there scrolling through these seemingly blatant mistakes, arms crossed, furrowed brow…

You might have even let out an audible Dwight Schrute, “idiots” outburst.

But please keep in mind, these are unfortunate scenarios in which these kind folks got something wrong (okay, more than just “something”) that may seem obvious to you as an after-the-fact Monday morning quarterback.

But what about you?

Do you have all of your bases covered?

There are lessons to be learned here that go far beyond the specifics.

And if we can have the humility to suspend judgement and see the problem at a higher level, we can start to observe gaps in our own thinking and actions that may, someday, lead us down a path we didn’t intend.

Give that a ponder.

And now, we’ll answer the question on everyone’s mind:

How does this apply to ME?

The Application of Intelligent Action

Whenever I speak…

There is always at least one person in the audience who has to let it be known that what I am preaching does not apply to them.

We’re too big.

We’re too small.

We’re already doing that.

We’re not ready to do that.

Our market is too progressive.

Our market is too conservative.

Sally and Jerry don’t believe in that.

Sally and Jerry do believe in that, but Mark doesn’t and refuses to brew unless we follow his lead.

Uggh!

Now… context certainly matters.

And in fact, over the next few weeks we’re going to be talking about exactly how to take context into account in the decision-making process.

For example: the same exact scenario presented to a 1,016 BBL/year 90/10 taproom/distribution split brewery, and a 2,357 BBL/year 50/50 taproom/distro brewery will often require diametrically opposed recommendations.

So.

While I will give specific examples in order to demonstrate the best practices we recommend… it’s worth noting some of the examples may come from production breweries producing far in excess of 5,000 BBL per year… or smaller breweries that fit the local taproom-driven, high-profit model.

That shouldn’t preclude everyone else in-between from reading between the lines and extracting your point of view.

What it does mean is that we need zoom out and identify:

- The general principle to follow.

- What the specific application of that principle would look like in your context.

This is the answer to the question above.

Age, volume, market, history, taproom vs. distribution, capacity, ownership profile, leadership team dynamics…

These variables all come into play, and are critically important in making the Intelligent-Action-style decisions we have been exploring so far.

So yes, I am willing to indulge your special snowflake syndrome.

But be warned:

Do not let this become a crutch…

…that prevents you from exploring new ideas, accepting advice, and moving forward when the time is right.

To that end, let’s take a birds-eye view of what Intelligent Action may look like at various (albeit oversimplified) stages of development:

- Startup. Before opening, you need enough information, objectivity, and discipline to formulate a realistic, risk-adjusted plan. The first goal: open on time and within budget. From there, though… the tenor shifts. We’re in the nimble, flexible, grind mindset. And that means decision-making needs to be fast, with quick tests and on-the-fly adjustments based on direct feedback. Build the best team you can afford, because more eyes on the problem and ears to the ground will facilitate speed. Begin to develop the habit of financial awareness, understanding that there will be some cost of learning along the way.

- Nano (3,5,7 BBL brewhouse). The goal is cash flow positive. Develop a unique experience in the taproom and PACK IT OUT. Start to push the boundaries on style. This size has the ability to make some cash, so seize it. Take your financial awareness a step further and build it into your weekly process. If a style or experience takes off, you will grow very fast and need the ability to make swift, yet informed decisions.

- Micro (<5k BBL). At this stage, the focus should be cash flow building. The target shifts towards turning a monthly profit. Each decision and step forward should either contribute directly to top-line growth or expanding the bottom line. Strengthen distributor relationships and go deeper in your home market. Further develop your team and vision. Implement financial controls. Your beer portfolio should be balanced, but we all know you have a racehorse beer.

- Micro+ (5k+ BBL). This is where strategies start to significantly diverge, so it becomes increasingly difficult to make sweeping generalizations. That said, leadership needs to be on the same page. The financials need to be on the table each month, and progress evaluated against budgets or the annual plan. You are running a business which is supporting the lives of 20+ employees. This is where the growing up happens, so pro-level discipline is the name of the game.

This breakdown doesn’t even begin to scratch the surface on the detail needed to apply Intelligent Action in earnest… but you can see the implications, no?

What may be a horrible idea at the Nano stage (e.g. expanding outside of the local market into new distribution territory) may be exactly the RIGHT move at the 7k BBL mark to keep the growth trajectory going.

And on the flip side, what may be a brilliant move early on (e.g. limiting the portfolio and packaging options to maintain high margins), could be extremely limiting as you build a regular customer base (as we saw in the half-barrel success story in the Winners section).

In the end, regardless of where you land on the spectrum…

I want to leave you with a pep talk:

THIS IS FOR YOU.

And if you are still churning on how this applies to your situation…

We’ll pick it back up in the next post in the series.