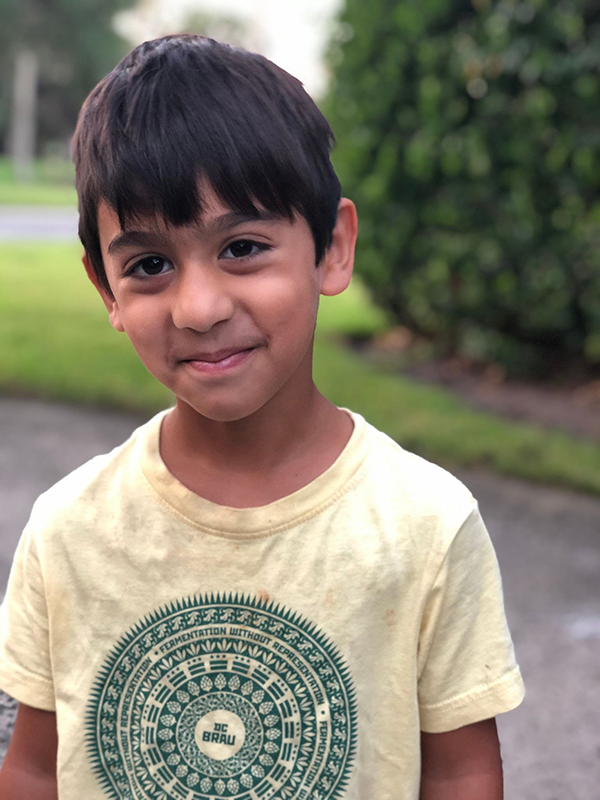

I sent my 5-year-old to kindergarten in a brewery tee-shirt… (BY ACCIDENT)

Poor guy, look how cute he is.

Anyways, the teachers did not think it was funny. They didn’t write him up, but they did send a note home, citing the code of conduct.

I take 100% responsibility for this and guess I need to pay more attention to what my children wear as we wade through the morning bustle of making it to the bus.

And to the teachers, they are just following the rules, earning their keep, I get it.

Speaking of earnings, I haven’t written about earnings of a brewery in quite a while.

Most of you have heard of the acronym EBITDA (earnings before interest, taxes, depreciation, and amortization).

We track EBITDA for our customers because it is a validation test to see how much cash the business is retaining.

The more pricing flexibility a business has, the better the EBITDA. I mean, who doesn’t want real time pricing flexibility?

Taproom models (DTC) have pricing flexibility. Meaning they can raise and lower prices as they want to. This has been especially useful in the past five years while the cost of everything has increased.

Wholesale heavy breweries do not share in the same fortune. Their pricing is tied to a market… the whole craft beverage market. So if the cost of ingredients and packaging has gone up 15%, per year, over the past five years…

Let me hear from all my wholesale breweries, have you increased the price 15% per year for the past five years?

This is why I get so pissed off when a craft brewery thinks they can create a cute lager and compete with price on the grocery store shelves. 12-packs, 18-packs, please… stop now.

Back to earnings.

Wholesale, what’s your plan?

If you can’t be nimble on pricing, and you can’t increase volume by 20x, then what do you do to stay in the game?

All of our research leads back to one thing:

Controlling general and administrative expenses.

We looked at 15 breweries, all wholesale dominant, and noticed that these businesses can maintain solid EBITDA if they have their G&A expenses in check.

Wholesale dominant breweries are defined by >80% of their revenue coming from wholesale sales. Breweries in this category should land between 1%-5% in EBITDA as a percentage of gross receipts at the end of the year.

Let this all sink in for a minute.

How does this look in practice?

If a brewery produces 5,500 bbl per year, 90% is sold through wholesale. $350 per bbl would put them around $1.7m in gross receipts, add in taproom, and total receipts should be around $2.2m. If the brewery is shooting for 3% earnings, this brewery would keep just under $70,000 for the year.

Stay tuned.