This is Part 1 of our Holiday Dip Series, where we tackle the problem from the finance side of the fence.

But first, before we get started…

“Do we have enough?”

“Will we have enough?”

These are the age-old questions I get from most of the breweries I speak to about the topic of cash flow.

In fact, the majority complain to me that the money flows out as quickly as it flows in. They are correct.

At the same time let’s not kid ourselves…

There are a lot of complexities in running your brewery. And that might make it feel like you’re a special snowflake. But the truth is, seasonality is far from a novel concept.

Seasonal Superstars Worthy of Study

So first things first today, let’s venture down the road to obscurity for a moment and take a look at a more radical holiday season example: Christmas tree farms.

Christmas tree farms represent the far end of the seasonality spectrum, and that makes them an instructive example to study. Because this is a business that not only generates the bulk of its revenue during a particular time of year, but in fact generates ALL of its revenue for the year within a 1-2 month window.

I just so happened to come across some intriguing numbers to frame the discussion in my regular reading of Profitable Plants Digest (what can I say, I don’t discriminate when it comes to profitability).

According to the American Christmas Tree Association, the average price of a tree at a u-cut lot was $74 in 2017. With 200 ready-to-harvest trees per acre, that’s $14,800. As the costs of growing Christmas trees are mostly labor for maintenance, such as mowing for weed control and shearing the young trees, a small grower who does their own work can keep most of the profits.

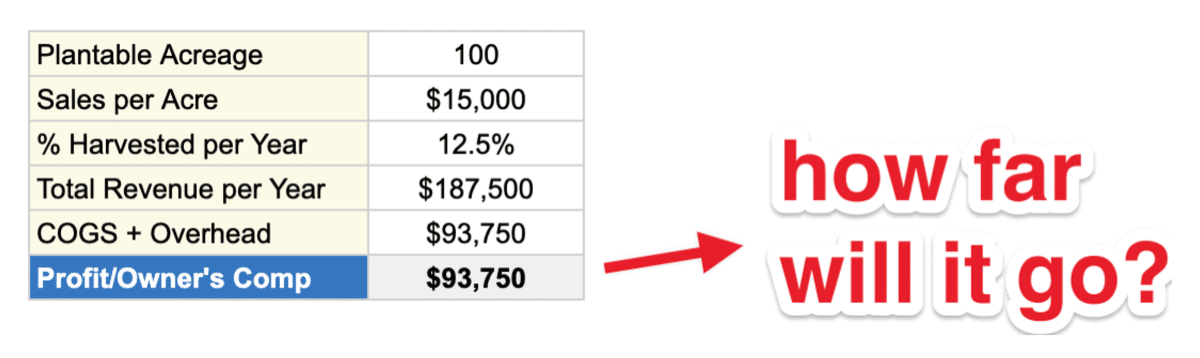

Now given that the USDA says the average farm size is 443 acres, let’s take a small farm example and assume that we’re now going to convert 100 otherwise unproductive acres into an X-mas tree goldmine.

At $15k/acre, with ⅛ of that harvested per year, we end up cashing in with $187,500 in revenue to close out the holiday season.

Assuming a generous 50% margin, Mr. Christmas Tree Farmer pockets a cool $93,750… and that’s not including the food, wreaths, lights, and other nic-nacs that could further bolster his haul.

A more glamorized example: The Deadliest Catch comes to mind, where in this interview one of the captains drops the, “Yea I think I grossed $2.5 million in 11 days” bomb on the flabbergasted Fox Business host.

But I digress… back to the good stuff!

The 3 Seasonal Solutions

So given his end-of-year success, our seasonal superstar farmer is left with essentially three different options (although not mutually exclusive):

- Do we stretch out that $94k for the rest of the year? The cash management approach.

- Do we throw a banger of a New Years party, blow most of it, pitch a tent, and live off the land Survivorman style for the remaining 10 months? The (extreme) expense reduction approach.

- Do we mix in some other profit centers to fill out the rest of the year? Fall festivals with pumpkins, hay rides, and corn mazes? A petting zoo in the summer? Flowers in the spring? The creative revenue generation approach.

Let’s bring it back.

One of our benchmarks for startup breweries is after your 8 month anniversary, you should be cash flow positive. If you are not, there is a problem.

But that logic doesn’t disappear as you grow older. It’s one of those fundamentals we tend to lose sight of as we see the revenue and volume numbers tick up and can “afford” to float ourselves along.

So that brings us to the financial target for The Holiday Dip:

Remain at least break-even December through February. Aim for for cash flow positive.

If you’re not hitting this target, I’d be willing to wager that without seeing your books and asking a few pointed questions, I could diagnose the problem with 98% accuracy. But I’ll save the Dave Blaine shit for later in the week.

Diagnose Your Holiday Dip

For now though, start with a few questions:

- Will you at least break even during your worst down month? If that is the case, congratulations! You’re running a highly profitable business. Most breweries though, are not in this boat. Do nothing and operate businesses-as-usual and you’ll run a loss, dipping into whatever cash buffer you have on hand.

- If not, have you built a large enough cash buffer to float the gap? Follow up question: Can you get on that for November? This approach requires more discipline to avoid letting the expenditures creep up during the good months, but is far less painful when sales dip. We’ll talk about how to execute on this tomorrow.

- Finally, if no buffer, can you cut expenses with precision? In exchange for running a net loss without a cash buffer, painful as it is we’ve gotta cut. We’ll cover the two approaches I typically recommend on Thursday and Friday.

In an ideal world, you’re powering through The Holiday Dip at breakeven or better. And if not, you’re covering the gap with a healthy cash buffer, ready to capitalize on the return in demand come spring.

That being said, life is not perfect. Things don’t always go as planned. And with that reality in mind, we need to arm ourselves with strategies to reduce risk and manage the downside.

Cash Management Phase 1: The Scrooge McDuck Strategy

News flash!

A cash reserve is a very good idea.

It’s the first line of defense against mistakes, uneven payments, and unexpected expenditures.

It also happens to be the “easiest” way to smooth out a net loss during The Holiday Dip if you’re running less than breakeven.

And as a side benefit, if you’re extra disciplined and build enough of a surplus…

You can request the back room at your local bank and give yourself the Huell from Breaking Bad, Scrooge McDuck treatment:

That said, because an on-hand monthly cash balance is important for the brewery any time of year, my recommendations for our “holiday cash buffer” are simply an extension of our general best practices.

So first…

How much cash should you have on hand?

For most of you, the largest and most frequent cash outlays will be cooperage or keg rental, raw materials, payroll, and packaging.

Let’s call them “The Big 4.”

The Big 4 can drain a bank account in minutes. So as a baseline, you need to establish a minimum cash balance in the operating account equivalent to the total of The Big 4. I am not suggesting this is all the cash you have, but you should at least be able to cover your largest expenses at all times.

That’s for a business-as-usual month.

Holiday-Dip-wise, if based on the diagnostic exercise from above you expect to be running at a loss assuming no changes to expenses, you’ll likely need 2-3x The Big 4 to carry you through the dip.

Let’s talk about how you get there.

How to generate and deploy your cash reserve?

If I haven’t finger-wagged you into deleting this email yet, here’s the process I recommend for starting the wheels turning on your holiday reserve:

- Open a savings account and transfer any additional funds over the minimum balance in the operating account. The psychology here is important, so rather than simply letting it accumulate in the operating account I recommend storing it elsewhere like a squirrel gathering acorns for the winter.

- If you are not in a position to start the buffer, set a goal to do it. As I alluded to earlier, November is as good a time as any with a large distributor stock-up order on the horizon before the dip commences.

- Then? Don’t use the cash in this account… until you intentionally decide to do so, having confirmed the dip in holiday demand. This “use it as a last resort” thinking may also be helpful to drive you and your team towards the common-sense expense reductions and new revenue generation ideas we’ll talk about next, that may take care of the negative balance on their own. The benefit? You get to leave your nice, cushy buffer to keep getting cushier (or at least dampen the drainage by only using what you absolutely need).

Now, of course this is ideal…

But if you (a) don’t have this in place, and (b) aren’t likely to get this in place within the mere 30 days left before the dip is set into motion, don’t fret.

This is just one of many tricks in my David Blaine hat.

The Plight of the Unprepared

Let’s actually drop the solutions focus for a moment.

And take a step back to gain a bit more perspective before we plow ahead.

Here’s a question worth exploring:

What happens if you DON’T heed this advice and plan accordingly?

In other words, what if you just simply decided to plow ahead blindly into The Holiday Dip?

What happens when the well actually dries up?

Here’s what I’ve seen:

- Some will cut back on expenses. This of course can be great (see below). However, as a general rule, reactionary cut-backs are significantly more harmful than proactive cut-backs. Precision is key, and when you’re operating in survival mode, precision and clear thinking are often the first things to go.

- Some will dip into their line of credit. It’s a quick fix that then requires a “slow fix” to recover from… all the while increasing risk exposure. As any addict will tell you, “just this once” is the gateway to dependence. Tread lightly.

- Some will rob Peter to pay Paul (I hate that saying). On the positive end of the spectrum, there is no doubt there’s cash that you’ve “lent” vendors with unfavorable contract terms that can potentially be recovered through renegotiation. But you can only play the shell game so long as the buffer isn’t eaten up and someone doesn’t call your bluff. This is a short-term option.

- Some owners will go without a paycheck for a period. The business exists first and foremost to create value for the ownership. When that disappears, eventually so goes the value created for the consumer, the employees, the community, and everyone else that benefits from there actually being a business there to benefit from. Unless there is an equal and opposite reaction (i.e. the ownership gets compensated proportionally on the upswing during the busy season), this practice becomes rapidly unsustainable.

- Some will lend the company money themselves. Bad habits die hard. After you’ve outgrown your startup training wheels, this (like the previous bullet) is one of them.

The problem with all of these, of course, is that they’re reactive, unintentional, and result in a step backwards heading into the following year. So again, just because you don’t have a cash reserve doesn’t mean you’re screwed.

If this happens, here’s what to do:

- First, stay calm.

- Next, create a simple cash flow tracker to determine how long you will be out of cash. This is an estimate of when cash will come in vs. The Big 4 and is an essential planning tool.

- Review all available terms with your vendors. Are you using the float to your advantage? Meaning, are you paying bills as they come in or holding for the period? You may find some of your cash reserve here.

- This week, I want you to ensure that your LOC is intact. Banks can and will restrict LOC access without communication, so get that on lockdown so that you have it available as a rip-cord option where needed.

Next…

Cash Management Phase 2: Clean Up The Consumables

One thing you quickly learn with three kids…

Is that nothing in the refrigerator is safe.

That block of aged cheddar and “artisanal” crackers you and your wife have been looking forward to, saving for a quiet evening after the chaos goes to bed? Yea sorry folks. It’s been torn into like a pack of rats.

Those cans of your favorite La Croix flavor you thought you carefully hid in the back corner of the bottom shelf so that you could ration your way through them? Somehow your rations have dwindled down to just a few lone soldiers. When did toddlers start drinking soda water?

That $300 trip to Costco you just took, finally stocking up in hopes of maintaining a full pantry for more than 24 hours? Welp, turns out AS YOU’RE STILL UNLOADING THE CAR your island has become host to a vulture-like feeding frenzy.

It’s almost like this is a cruel law of the universe:

The amount of food in the fridge <> The frequency of snack requests, evening raids, and general disappearance of the exact thing you were hoping to grab for lunch

Which means that in the end, we’re in the exact same situation most breweries find themselves in with the “extra” purchases they make throughout the year.

No matter how much extra comes in, it somehow seems to vaporize before you can get your hands on it.

That’s consumables in action.

First: What are consumables?

Any spending that is not tied to COGS, Labor, or OH.

When I perform a financial analysis I look at 5 things:

- Revenue

- COGS

- Labor

- Overhead

- The rest …consumables

“The rest” is what we need to focus on for our intentional Holiday Dip expense reduction exercise.

If COGS, Labor, and OH are in acceptable ranges, the problem is consumables. Which it usually is.

And this is where there’s “meat on the bone” that you can take advantage of to shrink the dip-induced negative balance.

Second: How do we fix the consumables problem?

A specific prescription is difficult because consumables are hard to pin down. They’re those creeping expenses that find their way in without notice. It’s the death-by-a-thousand-cuts phenomenon in action.

This is especially true when you’re in “Go, Go, Go” growth mode during the busy season. Just like any other business, you end up spending on whatever you need to (and plenty that you actually don’t) in order to keep the train plowing forward.

So the good news is, the slower volume that comes along with The Holiday Dip means that you have more mental space to put the focus on cleaning up.

And that’s Phase 2 of our recommendations:

- Take an afternoon to sit down and run through your last 30 days of expenses. Your CC statements are an easy place to start, and probably most revealing in terms of frivolous spending. Highlight each line item as you go through, and then generate a separate list so that you can categorize and prioritize appropriately.

- Start with the obvious low-hanging fruit. Cancel non-critical recurring expenses. Identify expense categories you can reduce or eliminate through directives to your team. Delegate this if you can.

- Plan on doing this again. Set your expectations appropriately. You won’t be able to put the brakes on everything using this process… but you will see reductions in the most egregious offenders. Schedule time to do this each month during the dip. It’s going to take a few monthly cycles to weed out the riff-raff.

- Set a budget. Easiest place to set a budget will be in the taproom. Start by having your taproom manager report what they have spent on consumables for the past 6 months, by month. From there see where you can cut, if any, and limit that spending from now until March.

Ultimately though, this once-a-month clean-out process is treating the symptom not the cause… and isn’t usually enough to curb your underlying spending habits.

It’s the equivalent of my futile attempts to maintain some semblance of fridge access policies at home. “Kids, Daddy’s row of stuff is off-limits okay?” while rational, is laughably ineffective.

In the end, it comes down to process.

Cash Management Phase 3: Stop The Bleeding at The Source

Some people call the holidays “the season of giving.”

When it comes to your brewery’s credit cards, I call it…

The season of taking.

Yes, Phase 3 of our Holiday Dip cash management plan is to stop the bleeding at the source.

And that means…

Step 1: Pull back all the credit cards

From now until March 1.

Don’t leave your delivery drivers stranded without a CC though… but everyone else, yes.

Even the owners.

Your reps, taproom manager, etc. will continue to spend, but when it is coming out of their pocket, the pattern changes.

It’s been well documented that CC spending decreases the pain of spending. Which means that people (a) spend on more types of things than they would otherwise, and (b) spend more on those things than they would otherwise (sometimes more than 2x). Let this quote from the 2008 study sink in:

the more transparent the payment outflow, the greater the aversion to spending or higher the ‘pain of paying’ …leading to less transparent payment modes such as credit cards and gift cards (vs. cash) being more easily spent or treated as play or ‘monopoly money.’

A.K.A. stop playing with Monopoly money and the consumables bill goes down.

Step 2: Rewrite your purchasing policies

But don’t just yank the cards. Create a purchasing system that ties in with your objectives.

Assign 2-3 people to do all the purchasing and who can then identify what needs to be purchased and what doesn’t need to be purchased. This gets you way ahead of the game on the targeted expense-cutting I recommended above.

Here’s what happens next:

- There are going to be a lot of pissed off people… but it just can’t happen anymore if the supporting revenue isn’t there. Such is life, folks. Bite the bullet.

- Meanwhile they can make a wishlist, right? There’s always a wishlist. Accumulate the list now with the team now, with the understanding that come busy season you’ll take a fresh look.

- I predict this tip will reduce new monthly purchases by $5,000-$7,000. If it’s more, please let me know.

So there you have it. Your Holiday Dip cash flow management solution all wrapped up in a bow:

- Figure out where you’ll stand when the dip hits.

- Establish and plan to (potentially) deploy your cash reserve.

- Stay calm and develop a dip season cash management strategy.

- Clean up the consumables.

- Get your Grinch on and give your brewery the gift that keeps on giving… reigning in the CCs.

With that, we’ve got our finance bases covered. But there is a Door #2, and you’re not always at the mercy of the market…

Next we dive into the fun stuff: makin’ it rain.

Until then…