I talked recently to a brewery looking to build a new taproom across town.

Their current taproom was packed nightly and they knew the potential new location to be a beer desert. They would make a killing.

The bank said no. They were too risky. They talked to several investment firms, only to be told they were over-leveraged.

What was going on?? Their taproom was busy every night and they were making money hand over fist. Net income was at a great level month over month.

But, when we reviewed the balance sheet, the issue came to light. Their Debt to Assets Ratio was at 1.2 (bad)! With these numbers, they are a risky bet for investors and would struggle to gain the financing they sought.

So, let’s talk about Debt to Assets Ratio, the third benchmark we discuss with our clients.

Company A vs. Company B

We recommend breweries be in the 0.3-0.5 range for Debt to Assets.

Practically, this means that you own 2-3 times more assets than you have debt.

From the perspective of an investor, this means that your business is less risky and can easily pay off its debtors through the sale of assets.

To calculate your Debt to Assets Ratio:

- Run a Balance Sheet Report.

- Then find these two lines: Total Assets and Total Liabilities.

- Divide Total Liabilities by Total Assets.

- This is your Debt to Assets Ratio.

To illustrate, let’s compare two hypothetical companies, Company A and Company B.

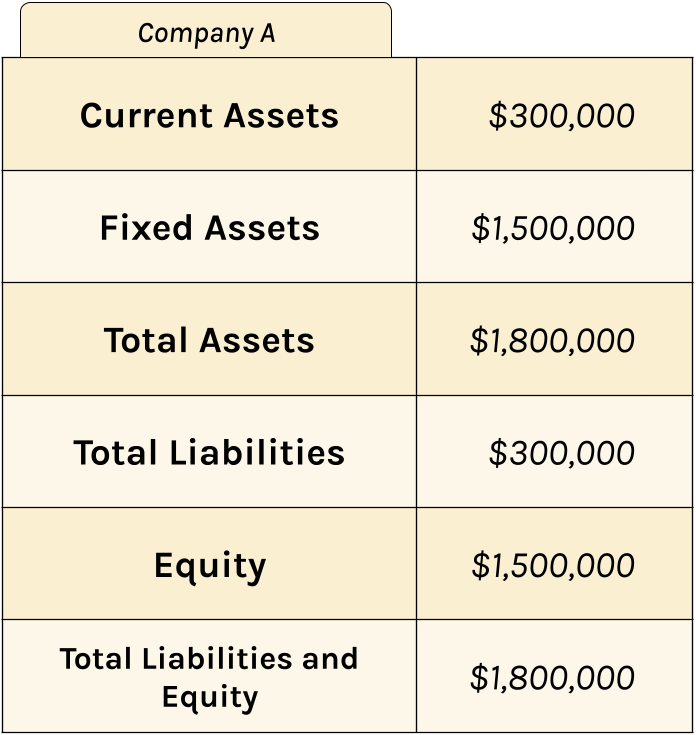

First, Company A.

Company A was strong right from the beginning. They started with good investors and didn’t have to take out many loans. The taproom was full from the start and cash flow has always been positive.

If we take their Debt ($300,000) divided by Assets ($1,800,000), it equals .17.

This company is in good shape and can easily pay off its debt when needed. It is a safe investment, at least from this perspective, and is attractive to potential lenders and investors.

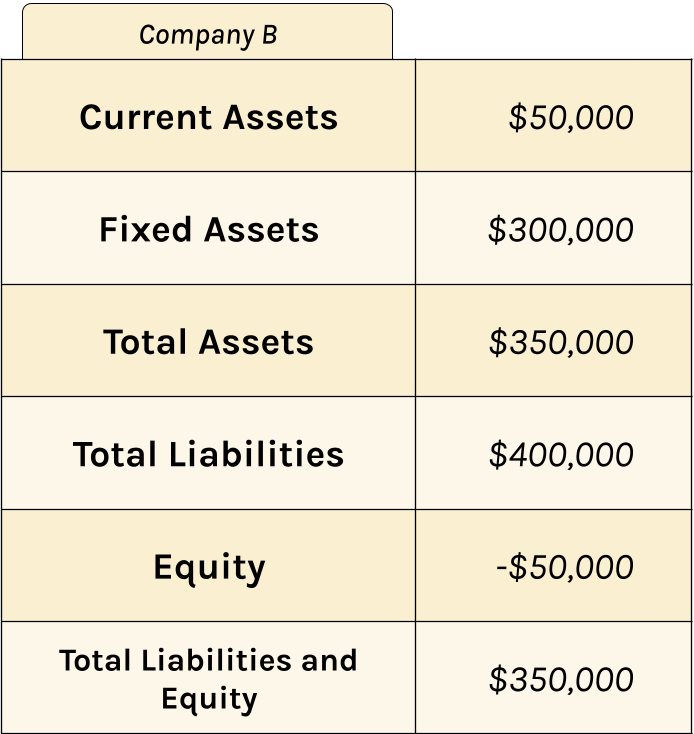

Now for Company B.

Company B had a very slow start. They experienced construction delays while still having to pay rent for several months. They had trouble filling up their taproom and used much of their cash paying overhead and payroll.

When we take their Debt ($400,000) divided by Assets ($350,000), we get 1.14.

This company is in poor shape. They are over-leveraged and need a couple years of strong cash flow from their operations in order to pay off debt and bring them back into the acceptable range for the Debt to Assets Ratio.

What should they do?

Improving Your Debt to Assets Ratio

To bring your Debt to Assets Ratio into range, assets have to increase or debt has to decrease.

Increasing assets will often require a loan (more debt), new investors, or more importantly, retained earnings.

New investors come with strings attached, but can often provide immediate improvement in Debt to Assets. However, they will also get a piece of your business and a say in the business direction. And as mentioned above, your business may not look like an attractive opportunity, given its over-leveraged state.

Of course the simplest way to bring your Debt to Assets Ratio back in line is to do the tedious but difficult thing, and just simply use cash to pay off debt.

While this requires a cash reduction in the short term (reducing assets), once your debt load is reduced then your cash will increase, as you won’t be paying off loans anymore, and your ratio will come in line.

All this with the caveat that you are running a profitable operation. If you’re not making money, you’ll only extend the decline with more investment or debt renegotiation.

We have 3 strategies to pay down debt faster:

- Increase your monthly payments

- Making additional principal payments

- Set an amount that you are comfortable with and commit to paying it each month

- Pay off higher interest rates first

- Also, once you pay off one loan, you can apply that monthly payment amount towards another loan, reducing the amount of time to pay it off.

- Negotiate a lower interest rate

- Uncomfortable, but hey, the worst the lender can say is no.

- At the time of this writing, the SBA has made available up to $2 million at a 3.75% interest rate over 30 years. If this is lower than your current interest, it would benefit you greatly to take this money and pay off your higher interest loans.

Each of these strategies have pros and cons, so think about which is best for your current situation and explore your options.

So, back to our client looking to expand, that I mentioned up top.

They’re a bit stuck. Opportunity is knocking and they can’t open the door. It will take time and intentional work to be able to secure the funds they need.

So the takeaway is this: if your Debt to Assets Ratio is high, plan to do something about it sooner rather than later because…

Improving it will make your brewery into a much more attractive opportunity for potential investors and lenders.

Don’t delay.

Be proactive.

And get your Debt to Assets Ratio in line so that when the time comes…

YOU are the one in the driver’s seat.

-Derek