Profit Players,

If your Cost of Goods Sold isn’t dialed in, your margins might be telling you a different story than reality…

This week we’re talking about how to make more profit by understanding your Cost of Goods Sold, or as us accounting folks like to say:

COGS is one of our favorite acronyms, and it should become one of yours too.

A brewery called me a couple of months ago, convinced that everything they bought for the manufacturing process was considered COGS.

Remember our recent video on inventory? We discussed how inventory affects cash flow and what it means when inventory piles up on your shelves.

Well, here’s the key point: When you purchase something for manufacturing, it’s actually inventory — not COGS.

COGS only comes into play when you sell the product. That’s when you record it as a Cost of Goods Sold.

If your COGS is inaccurate, your margins will be off, your financials will be skewed, and decision-making becomes way harder than it needs to be.

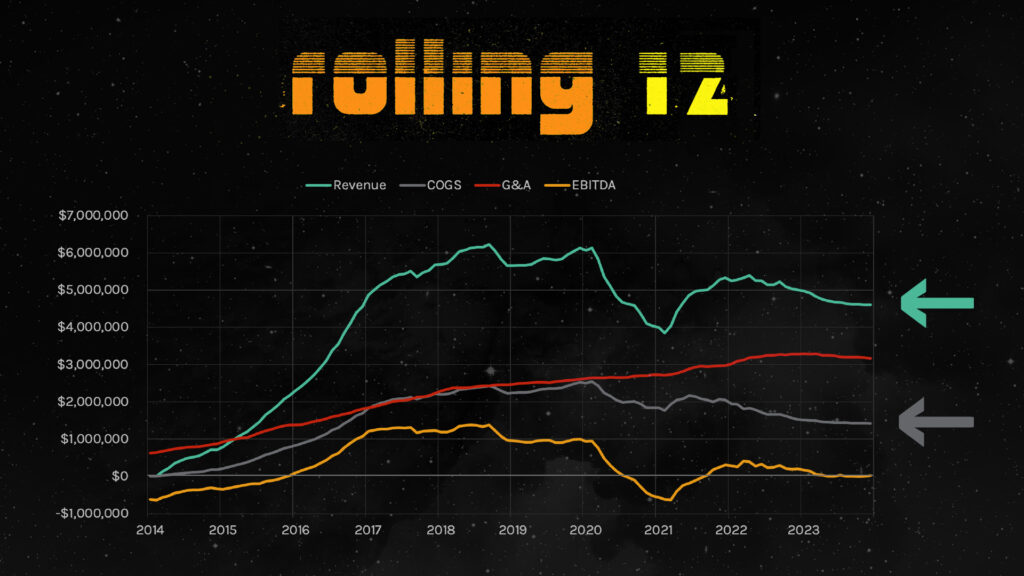

Look at this graph.

We call this a Rolling 12 here at SBS. For the sake of simplicity, we’ll focus on the green and gray lines.

- Green represents revenue or sales.

- Gray represents COGS.

If your financials are set up properly, your COGS should follow your revenue closely — rising and falling together. In this example, the gray line mirrors the green line nicely, which is exactly what you want to see.

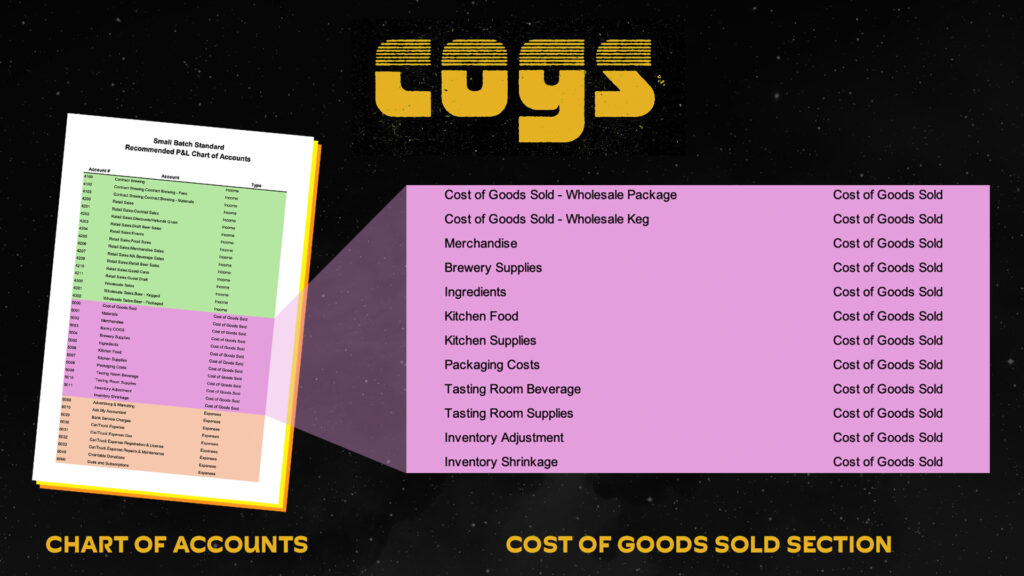

You’ve seen this before, but let’s revisit your chart of accounts.

Your COGS section shouldn’t look like the entire Harry Potter series — it doesn’t need to be that long! Remember, we’re just capturing the costs of items you’ve sold.

If you’re using a brewery management system like Ekos, they’ll provide a predefined set of COGS categories.

Here’s what a clean chart of accounts might include:

Wholesale Package

Wholesale Keg

Merchandise (makes sense since you’re selling it)

Brewery Supplies (for items like chemicals, yeast, and gas that are hard to allocate per batch)

Ingredients (if you sell raw ingredients)

Kitchen Food & Supplies (when selling food at your taproom)

Packaging Costs (sometimes breweries sell packaging materials)

Tasting Room Beverage & Supplies

Inventory Adjustments & Shrinkage

Lastly, I want to call out inventory adjustments. Every month, you’ll compare your inventory counts to your brewery management software and make corrections. If those adjustments are significant, you should be getting a call from those doing your financials to figure out what went wrong — whether it’s a forgotten bill entry, skipped software steps, or something else.

Our goal isn’t just to adjust and move on; we want to uncover why the numbers were off to prevent future issues.

So there you have it!

COGS: it’s all about tracking the true cost of what you sold each month.

See you next week!

-cf

P.S. – You can find other parts of the Back to Basics series below:

Part 1: Chart of Accounts

Part 2: Prepaids

Part 3: Inventory

Part 4: Fixed Assets

Part 5: Liabilities

Part 6: Revenue

Part 7: COGS (you are here)

Part 8: Labor