If you’re anything like me, sometimes you just gotta hit the road on a totally aimless Sunday drive.

- comfortable seats

- fuel efficiency

- monthly payments

- cup holders

- bluetooth

- reliability

The Only Prescription, Is More...

With a call-back to every high quality 4th grade research paper…

Google defines “bookkeeping” as follows:

bookkeeping (noun): the activity or occupation of keeping records of the financial affairs of a business

In other words, it’s an activity to be performed. And this is precisely where, if we’re not careful, things start to go off the rails.

Left unchecked, the support functions within any business that are just outside the main gaze of the business owner’s focus, are what end up either (a) left to fend for themselves in a sea of chaos, or (b) ballooning into a functional, yet bloated, mix of stuff you need, but a lot of stuff you don’t.

Case in point, very often when we open up a set of books for the first time from a (typically well-meaning) brewery we find:

- Total disaster-town. It’s been pushed to the side or written off as “something only the bean counters care about,” lost in the fray of brewing beer and trying to make it all work.

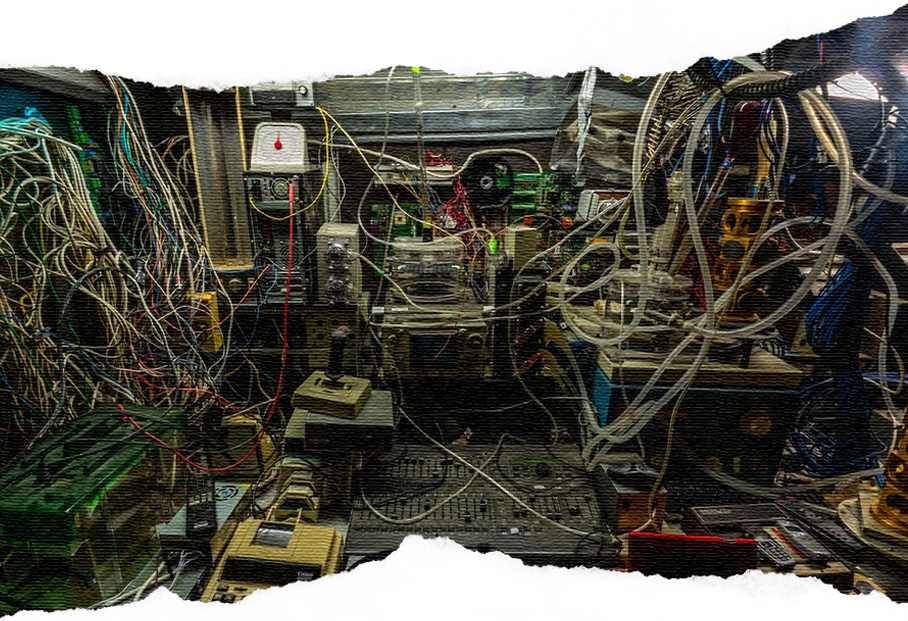

- A Rube Goldberg machine. This usually happens when a more financially aware owner has been driven right into the arms of the “bookkeeping experts” who (according to our definition) are incentivized to… do lots and LOTS of bookkeeping.

In the first case, we’re operating in la-la land, running the business by the seat of our pants. Which CAN work for sure… until it doesn’t.

In the second, this is where we end up with unnecessarily approvals and processes, big giant SAP-level software packages that create 3 new issues for every one they resolve, and bookkeeping “bridges to nowhere” littered all over your P&L and Balance Sheet.

And sure, there’s probably a personnel, or software, or process change that could tighten things up. But either way, without addressing the root cause, we go on to the next thing, only to find ourselves eventually right back in the same spot.

Because when bookkeeping is an end unto itself…

The only prescription, is more of it.

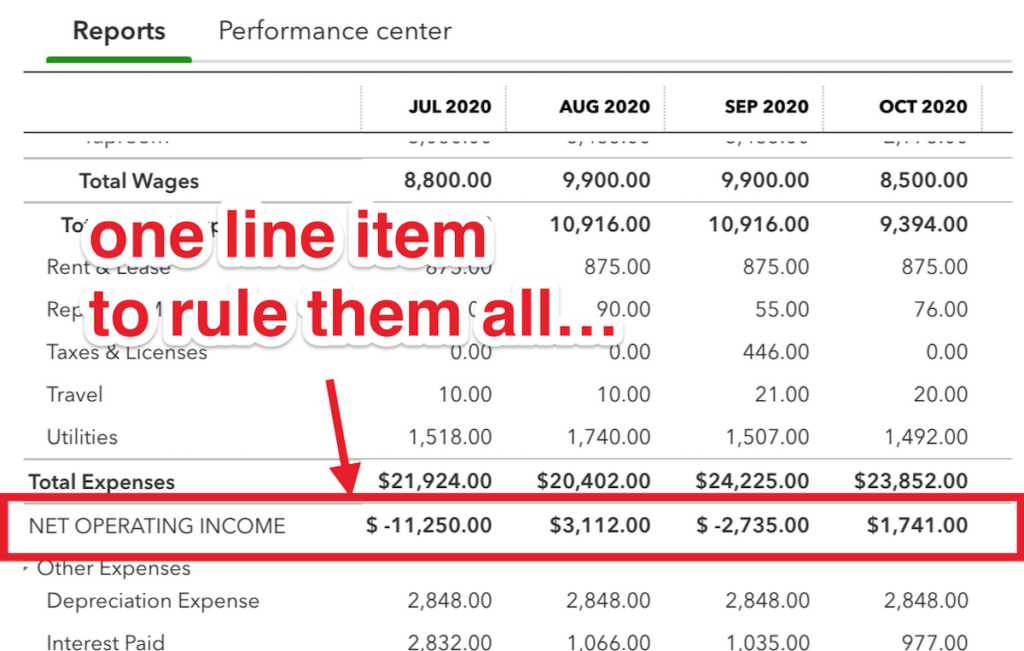

The Goal: (keeping) Profit

Seems like a worthy goal, no?

And as we learned from Mr. Farmand a few weeks back (inexplicably delivered to us in-between the steering wheel of his vehicle): profit is indeed the goal of every business, and we should never apologize for placing profits first.

So what if instead of viewing bookkeeping as just an “activity to check off” no different than filing for a Trademark or passing an inspection…

We viewed it as set of activities with a very specific goal:

Ahh, now we’re getting somewhere.

Because now when we put our bookkeeping activities through the “Is this helping us generate profit?” filter, it snaps us out of “Sunday drive” mode, and into a more cutthroat “Morning commute” mindset.

With that goal in mind, bookkeeping now has two very clear objectives, with a few important but lower priority side effects:

We want to collect accurate information yes…

But ONLY the information that’s important, at the level of detail that matters. A couple examples:

- That 357.14 Amazon charge from yesterday? Whether Supplies and Materials, Repairs and Maintenance, or Office Expense, it all ends up overhead in the end so turns out, not so important.

- Properly inventorying your grain, hops, yeast, cans, and PakTech carriers and then debiting into COGS when product is sold so that you know exactly how much margin your 16oz DIPA is making… now that’s something worth investing some effort into.

One is just an activity for the sake of completeness.

The other is an activity with the specific purpose of providing profit-generating information.

We’ll talk more about the systems needed to generate said information later on in the week, but the first point here is that your books shouldn’t feel like something “over there” that the accountants deal with…

But instead an integral part of the work that makes the business successful.

And the only way to do that is to code transactions and prioritize processes that are actually useful and reflect the on-the-ground reality the team is seeing each day.

That means:

- Prioritizing the important buckets: AP, AR, revenue, inventory, COGS, labor, occupancy, location classes, etc.

- Giving a proper dose of treatment to the necessary ones: tips, tax, interest, fixed assets, capital, distributions, etc.

- And allowing the rest to fall into general categories that you can track and analyze on an as-needed later.

Next…

Minimize cost and hassle.

Again, if the goal is to make the brewery more profit, then we also need to consider the cost associated with bookkeeping, both:

- The cost of the activity itself. How much you’re paying yourself, a team member, or someone else for it. But also…

- The opportunity cost compared to what you (the owner) or your team could be spending that time on if not bookkeeping (more about this on Thursday).

Here it’s all about efficiency and minimizing waste, getting the work done well, but also as quickly as possible while reducing moving pieces.

Part of the solution here involves software and automation (which we’ll talk about on Wednesday), but some of it is also about skill, expertise, discernment… to be able to determine what’s important and what’s not and be ruthless in removing the wasteful activities in favor of those that are actually useful for the business

These are at the bottom, because in our opinion, when done right, bookkeeping first serves those top two objectives…

But then in the process provides all of the accurate and easy-to-report sales and excise data the brewery needs to file each month and quarter… as well as has all of the information booked and ready-to-go when your tax preparer comes a-knockin’ each spring.

Lastly, that good ole’ minor inconvenience of funding this capitally-intensive enterprise of yours. Clean books are a boon to banks, investors, and wherever else you secure your flow of capital from

Bookkeeping for Breweries: Our Definition

With all of that, I think we’re ready to take a stab at a reformulated definition of bookkeeping that works far better for the goal we have in mind:

bookkeeping (noun): a set of reliable, efficient processes designed to collect the data the brewery’s leadership needs to make decisions that generate more profit

For the owner/operators out there who have hung on to bookkeeping yourselves, you intuitively understand this difference. Which is why it’s so hard to get it off of their plate.

Because whomever you choose to delegate or bring in to tackle the books may understand how to go through the motions of collecting receipts and invoices and making journal entries and checking account balances… all of the “activities.” But that person usually doesn’t have that fundamental connection to the bottom line success of the company each day.

And so that still falls on you (again, more on this later in our journey).

For now, armed with this updated definition, we can move on and confidently use this frame of reference to filter out the good, the bad, and the ugly when it comes to bookkeeping.

Which is exactly what we’ll get into next:

The spots where bookkeeping goes off the rails within the brewery…

And how we can flip the script.

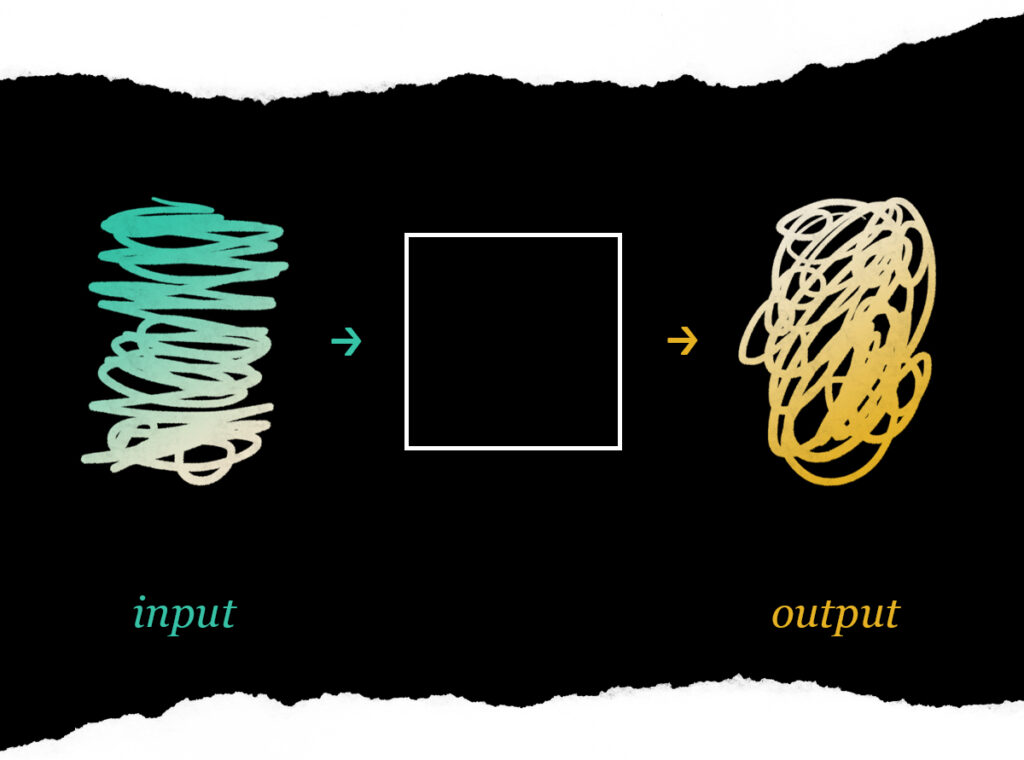

Ever heard the term garbage in, garbage out?

(Apparently I’m a big fan of definitions.)

GIGO is “the concept that flawed, or nonsense (garbage) input data produces nonsense output.”

And after last chapter’s shellacking of how most people treat bookkeeping, I’m sure you already know where I’m going with this.

If bookkeeping is what produces the “input data,” then the “output” should, in theory, be all of the wonderful outcomes we come to expect (financial clarity, smooth cash, less hassle)…

Which unfortunately seem to be in short supply in our industry.

So to prepare for today, I asked the team to indulge themselves and outline what they thought the biggest issues were with the books they receive from breweries…

And so to spare you from the equivalent of Barney’s QuickBooks Pro demonstration at Leslie’s dinner party…

We’ve simplified and summarized them into the three biggest offenders:

- Payments and cash management

- Properly receiving revenue

- Managing the Chart of Accounts (what shows up on your P&L)

In each section we outline where the typical brewery goes wrong, and then our recommended remedy, with plenty of actionable takeaways.

And this one goes deep, so feel free to skip around.

Let’s do it!

The AP Shell Game

Back to the ideal scenario we outlined last week:

Every owner wants smooth, predictable cash flow, without being mired by the vendor, invoice, bank balance dance each week in order to make that happen.

In our eyes, the goals of this Accounts Payable (AP) process are simply:

- Pay your bills on time.

- Keep cash in the bank.

- Maintain your sanity.

Sadly, it turns out cash management while running a brewery is quite difficult, and so our objectives are rarely achieved.

Where it Goes Wrong

Left unchecked, most breweries end up with a mess of payments to make for ingredients, cans, team, supplies, equipment, you name it… and no good way of keeping track of what’s due when, to whom, and whether they’re able to handle it all without draining the operating account.

And that leaves the individual cutting the checks (i.e. you) smack dab at the bottleneck of the whole process. Which means, given the owner’s massive todo list, that payments happen at the last available moment, reactively, to just “solve the problem” and move on to the next thing.

Some scenarios to illustrate:

Scenario 1: Brewery A is in the process of building out a new location and is using operating cash from the existing taproom to fund it. Owner #1 oversees finance and is responsible for managing AP. But Owners #2 and #3 are managing the taproom and the new location buildout respectively, paying with credit card sub-accounts, signing on contractors, and creating a whole spectrum future cash liabilities for the brewery. Because they’re all insanely busy, these three tend to run-’n-gun and then circle up to pick up the pieces later. Unfortunately, because there’s little visibility into cash an expenses, that leaves Owner #1 holding the bag each week, doing the delicate dance of: pay $10k here, late $23k hops payment there, let this balance ride, and hope for the best! The YOLO method.

Scenario 2: The co-founder of Brewery B is handling the books himself. He’s okay on the straightforward tasks (coding transactions, scheduling payments, etc.) but it’s the more complex stuff that sends him over to Google to figure out a way to make it work. We’re talking: receiving updated orders in Ekos that don’t match the originally booked prepaid amounts, figuring out how to match up vendor balance payments when credit memos need to be applied, and fixing incorrect inventory adjustments after the fact. He’s doing “things” to get by, but because they’re not correct, the mess just compounds and compounds until in the end we find ourselves with a sea of red in the QBO Unpaid Bills screen.

In the first scenario, we end up in this vicious cycle of always chasing our tail on cash, and in the process creating more and more disorganization that then needs to be backed out and fixed if we want an accurate read on AP.

In the second, although less reactive, this work is juuuust complex enough that the out-of-the-box instructions aren’t quite enough to get you where you need to be without some accounting experience under your belt.

Regardless, what we’re left with is:

- Unpredictable cash outflows that regularly surprise us in their impact the operating account… which often leads to unnecessary credit usage, bounced checks, and a whole slew of distractions that prevent you and the team from focusing on the stuff that’s actually important (brewing beer, making money, controlling spending).

- Totally unusable vendor reporting. Where even if you wanted to run an AP Aging Report to manage all of your outstanding bills… you wouldn’t be able to because of the mass of unmatched invoices that have built up with each direct vendor payment.

- This constant feeling of being behind the 8-ball. Even in great summer months when the taproom is raking in the revenue, instead of sharing the feeling of success with the team, you’re left waiting for the next shoe to drop.

No bueno.

The Remedy

If the issue is a lack of process, the remedy is its opposite:

A straightforward, clear, repeatable process for handling invoices, bills, payments, and cash.

Here are a few key principles to keep in mind that, if obeyed (regardless of software, staff, or systems), will put the brewery’s AP on the straight and narrow and exit you from the shell game once and for all.

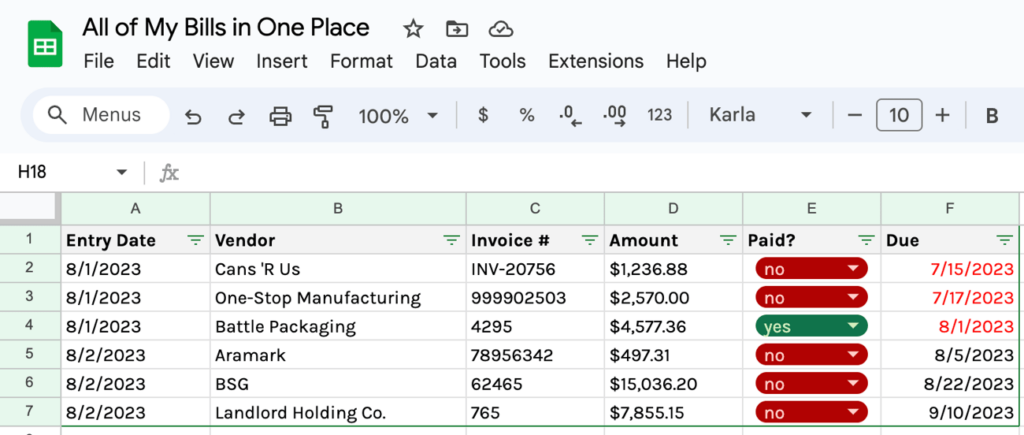

AP Principle 1: All bills in one place.

If you know us at all, you know that our preference for AP is Bill.com.

But even if you’re not amongst the converted and pay everything with credit, physical checks, or gold bullion, the simple act of sending all of your invoices into one central storage location to be processed will go a looonng way towards gaining control and visibility.

That could be the Bill.com Inbox and Unpaid Bills screen. That could be the QBO Bills tab. That could be a good ole’ shared Google sheet.

Whatever it is, all of the bills to be paid go there. You know it, the team knows it, and you put a simple set of rules in place for ensuring that process is followed.

Taking this a step further:

- Principle 1A: Organize all invoices by amount and due date. (based on the terms of the agreement). That means two extra columns in your theoretical Google sheet. Sort in ascending order by due date, and voila! You have something starting to look like an AP projection.

- Principle 1B: Every bill is clearly marked “paid” or “unpaid.” Seems like a “duh” rule to follow right? But you’d be surprised at how often this simple additional piece of information is not included, and creates pure havoc in its wake. So now that you’ve added that column, filter your list by “unpaid” and you have instantaneously created for yourself a very clear payment schedule for all of your upcoming bills.

- Bonus: Turn off auto-payments above $500. Get those invoices flowing through the same system outlined above for an even higher level of control of what hits the account, when, and what the impact will be.

AP Principle 2: Pay the invoice, not the balance.

This one again, is straightforward, but often bypassed in the interest of just paying down the current balance with your vendors so that the problem goes away.

But… by taking that extra step to always have a specific invoice (or set of invoices) that you’re paying, rather than whatever balance shows up on the latest statement, and then matching that payment to the bill in QuickBooks when it’s processed, a few things happen:

- You significantly reduce risk of duplicate or missed payments.

- You almost entirely eliminate the need for future research, digging around in inboxes for emails, and more generally the blood-boiling annoyance of always having yet another vendor “issue” to resolve.

- Your Vendor open balance reporting in QBO actually becomes a useful tool (rather than a graveyard of long past bills).

Now we’re getting somewhere…

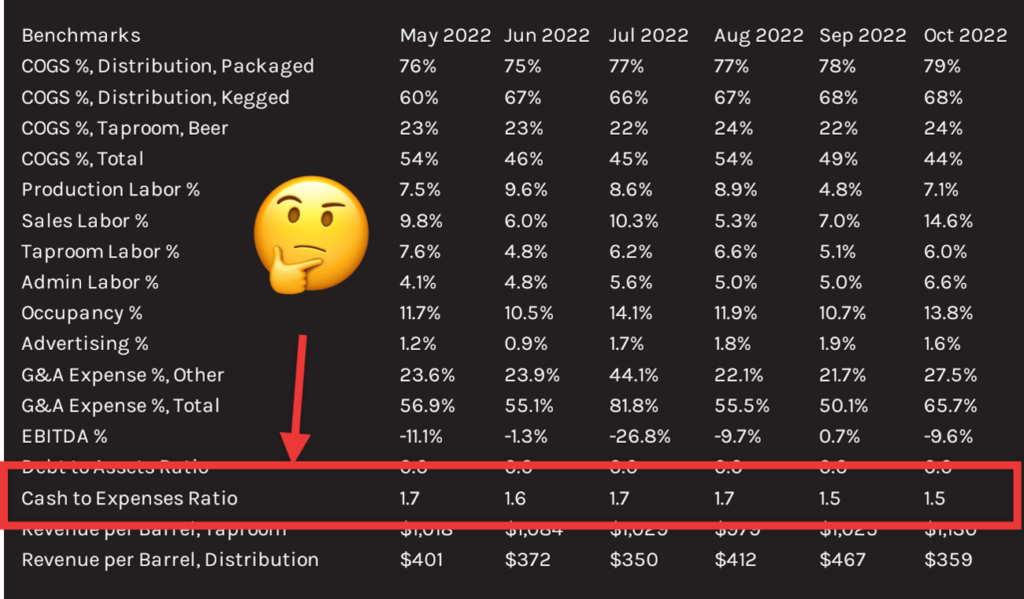

AP Principle 3: Maintain a minimum cash balance of 3x monthly expenses.

And yes, you caught me. This is more of a finance principle here so I’m cheating a little bit, but it’s so intimately tied to what happens with AP that we’ve gotta bend the rules here and include it.

While Principles 1 and 2 will keep you organized and provide great visibility, if you just don’t have enough in the bank to cover your next 30-90 days of expenses, the best AP system in the world isn’t going to prevent you from having to play the shell game and pull your hair out in the process.

How to properly manage working capital is long discussion for another day. But the point for now is: this isn’t a moral stand against using credit, but instead a pragmatic rule to prevent you, your team, and your partners from pulling your hair out trying to figure out why the hell there’s never enough cash in the bank, even during profitable periods.

And so the cash buffer principle is simply meant, in combination with the visibility that the other AP principles provide (as well as the AR principle we’ll talk about momentarily), to give you space to operate and enable you to see the drawdowns coming before they hit and act accordingly.

The AR Tangle

Now if the goals of AP are all about ensuring payments are organized and supplied with enough cash, the goal of your Accounts Receivable (AR) system should be to generate and supply said cash that is necessary to make that engine turn.

And even though it tends to be less hands-on (unless you are self-distributing to hundreds of accounts in which case god bless), AR can go just as wrong.

And so before taking a closer look, let’s just outline the main objectives here:

- Collect on the money you are owed.

- Receive that money into the right revenue buckets.

- Do all of it scalably, so that it doesn’t become unmanageable as you grow.

Let’s see what we typically uncover.

Where It Goes Wrong

Again taking a look at a pair of scenarios:

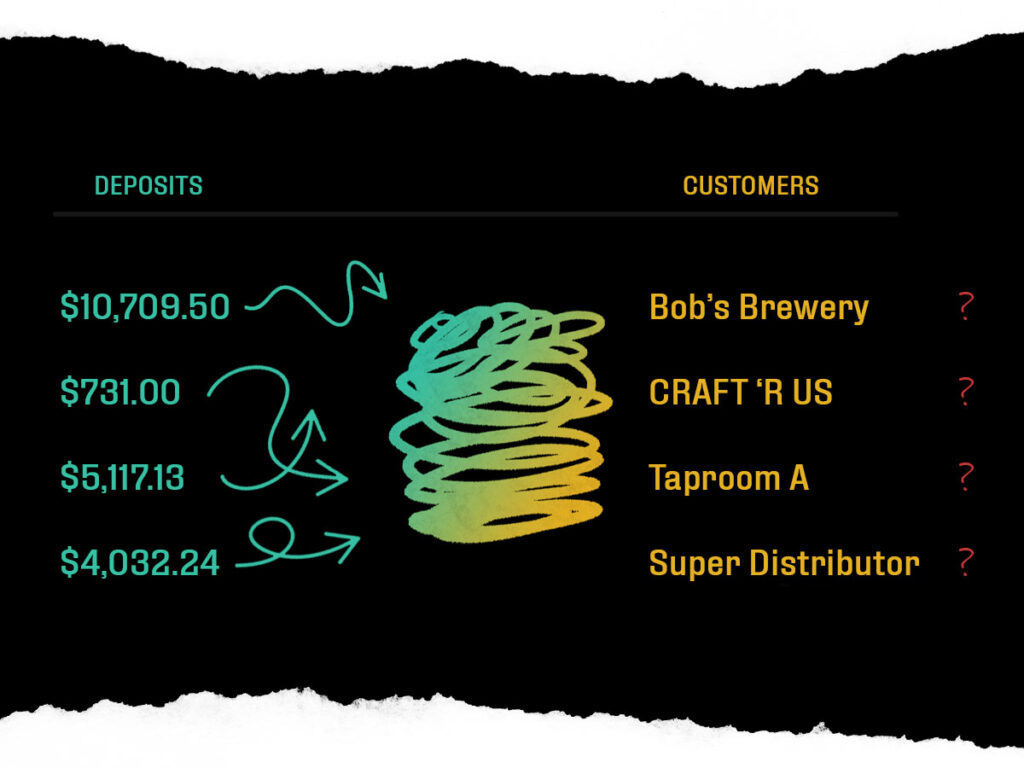

Scenario 1: Brewery C self-distributes to 50 accounts. When money comes in, strapped for time, the co-founder responsible for finance just books it directly to Wholesale Income rather than receiving against the invoices they created. Some customers pay on time, others don’t. The problem? Now they have absolutely no idea which of the open invoices in QBO are actually overdue and which have already been paid. Welcome to hell.

Scenario 2: Brewery D receives a daily lump sum deposit from their Clover POS system. All of the reports out of the system itself give the Taproom Manager what she needs in order to track sales each day and manage accordingly. And so the Office Admin back in the office just books those deposits into Taproom Sales. The problem? We now have no visibility into whether or not the beer, liquor, food, merch, or any number of other revenue sources coming in are up, down, profitable, or not… And if the plan is to after-the-fact manually enter in a Journal Entry at month-end to clear everything up… Well to that I say: “good luck to you, mam.”

The Remedy

AR Principle 1: Every deposit matched to its source.

Meaning that for every income deposit that hits your bank account, it doesn’t get booked in your accounting software until it’s been matched up to an invoice you’ve sent to a customer, or a Journal Entry that’s come over (or has been manually entered) from your retail POS system.

Yes, you may be managing customer invoices out of a different platform. Yes, your POS may not sync to QuickBooks (or if it does, it’s hard to manage). Yes, there are plenty of scenarios that make this a bit more difficult to accomplish.

All we’re saying is that as a general rule, if every deposit is matched to it’s source you’ll have:

- A complete accounting (assuming proper COA setup – see below) of all of your revenue, broken down by source, for clear decision-making.

- A clear view of all of your outstanding AR that still needs to be collected, making it easy to run an AR aging report by customer, project out future cash inflows, and follow up accordingly.

Speaking of POS and invoicing, that brings us to some software and process best practices, which we’ll cover more when we talk automation tomorrow.

Last up…

The COA of Doom

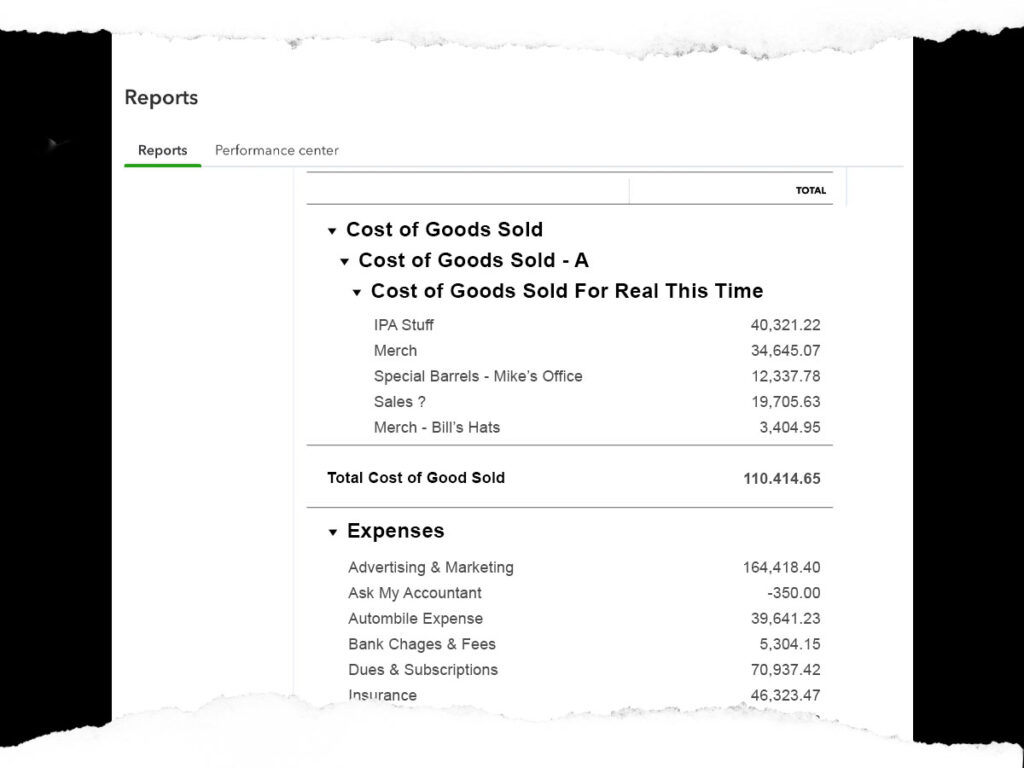

You know the 317-line long monstrosity of a P&L that you have to sift through each month?

Yea, that doesn’t (and shouldn’t) be so complicated.

And it’s because your Chart of Accounts (COA) has taken on a mind of its own.

This is likely because unfortunately, whenever an innocently detail-oriented admin gets their hands on your Banking screen (owners included!), we end up with all sorts of unintended consequences by the time the published financials hit your desk later on in the month.

Where It Goes Wrong

To summarize, we regularly see this go wrong in the following three ways:

- No top-down COA organization. Which means accounts are being created on the fly for all sorts of supplies and materials, tax payments, short-term liabilities, you name it.

- Improper class usage (or lack thereof). Which means either trying to manage and organize a complicated web of departmental classes (”Does this count as overhead? Or sales? But they used some in the taproom?”), or worse, creating additional accounts instead.

- Unnecessary levels of detail. Which are almost always better served by reports from other sources. Need retail sales data by SKU? Pull it out of your POS reporting. Need an Office Expense breakdown? Run a Transaction detail report.

Which is all just a way of saying there’s typically a setup knowledge gap.

For example, the class thing gets so jacked up I can’t even figure out how to show a good example, but if the Income section of your P&L looks something like this:

▾ Income

▾ Sales – Main Street Location

Taproom Sales – Main Street

Wholesale Sales – Main Street

▾ Sales – Party Road Location

Taproom Sales – Party Road

Wholesale Sales – Party Road

Then you’ve gone astray of proper class usage, which eliminates the need to duplicate accounts. Because like in this example, each new location added essentially doubles the line items on your original P&L that you then have to sift through… line after line of confusing madness.

But even worse than that, try coding a transaction in QBO, Bill.com, or any other platform that pulls in your chart. “What was the Main Street Taproom Sales > Event Sales account number again!?” Goooooood luck with all that.

The Remedy

And so the remedy is the reversal of those three issues.

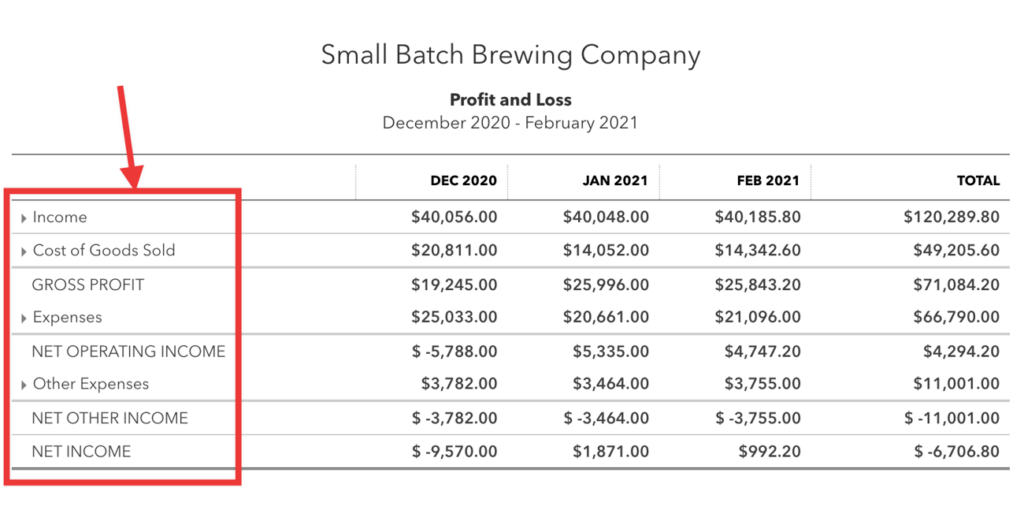

COA Principle 1: Top-down first.

This is one place where some proactive forward planning really pays off in the long run. The easiest way to tackle this is from the P&L. (We’ll need to eventually provide similar treatment to the Balance Sheet, but that may be out of scope without your accountant’s guidance, so I’ll set that aside from now.)

One way to do this:

Start with the simplest possible P&L you can envision. Run a Profit and Loss report in QBO and then roll up all of the top-level accounts until you get something that looks like this:

Then, work your way down into each sub-account you’d need to add under each top-level account in order to see enough detail to make ownership-level decisions without getting bogged down. Then go back and revisit your original P&L to decide what to keep, kill, or combine, keeping in mind there will be a few in there your tax preparer may need.

Or if you’d like to shortcut the process…

Here’s a link to an example chart of accounts we’ve put together you can use as a starting point.

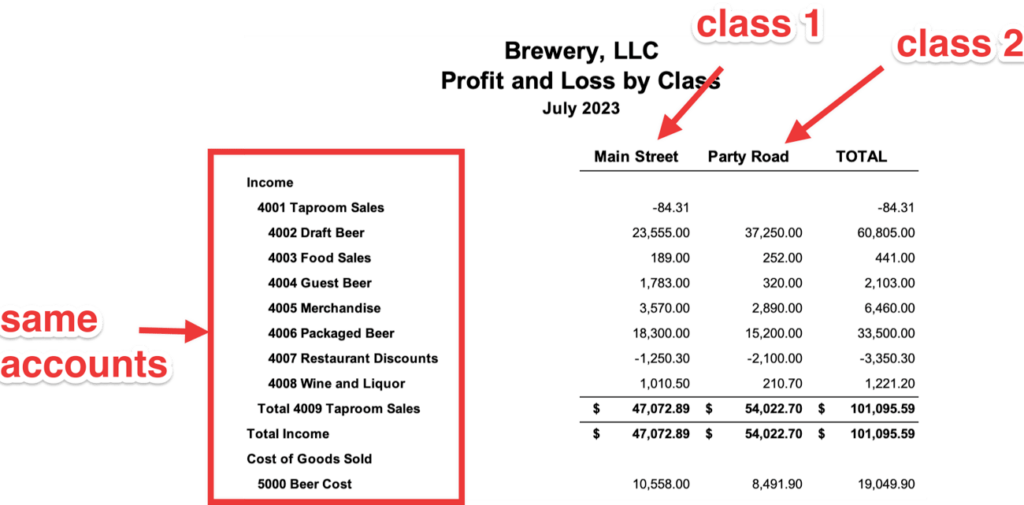

COA Principle 2: Locations get classes, not accounts.

This one’s pretty straightforward. Turn on class tracking if you’re on QBO. Add each location to your Class list. Then code each transaction with a Class in addition to an Account. Done right and you end up with and nice Profit and Loss by Class report (Reports > Business overview) that (hopefully) looks something like this:

With the ability to run a regular ‘ole consolidated P&L by month without changing any of the underlying data.

COA Principle 3: The 100-line rule.

Go to Reports > Profit and Loss > Report period: Last Quarter and hit Run report. Then click Export to Excel and open that sucker up.

If that P&L is more than 100 lines long, you’ve got a problem.

Gut check: We have breweries doing 5,000 – 20,000 BBLs in volume across multiple distribution channels, taproom locations, and DTC that have sub-100 line P&Ls. And even those could be stripped down further.

Maaaybe a case could be made for up to 150, but anything beyond that you typically have an excess detail problem, and are better off consolidating accounts so that you don’t obscure the important high-level conclusions that the brewery’s leadership needs to pay attention to.

Besides, you can always just drill down into a more detailed transaction report for any account that requires further analysis.

Next up…automation and software…

You know, the stuff that sounds amazing but rarely works the way you want it to 🙂

Before we do anything else…

Let’s kick off this next chapter with a moment of gratitude.

Because thanks to the wonders of technology, we no longer need a smokey back room filled with a giant team of bean counters in those funky green visors, clacking away at 10-keys in order to generate some super-basic facts about how your business is doing.

This is an amazing thing!

We’ve got all sorts of real-time, automated data at our fingertips that can tell us virtually anything we want to know about any aspect of how the brewery is performing. We can go full Tom Cruise with the gloves from Minority Report!

As Arthur C. Clarke puts it:

“Any sufficiently advanced technology is indistinguishable from magic.”

Ahhhh…

Hold your horses there partna.’

Let’s not kid ourselves.

Although we have indeed come a long way…

And what we’re going to cover today holds the potential to drastically streamline your bookkeeping process (when paired with the best practice principles we outlined last chapter)…

At least until Skynet takes over, it’s not all rainbows and unicorns in the software department quite yet.

Technology: An (Intelligent) Embrace

We have an running joke internally here at SBS that while we may seems like we do accounting and consulting…

We’re actually just a tech support firm.

(I know, hilarious bunch we are.)

In all seriousness though, Embrace Technology is one of our core values.

The ability to rapidly learn, implement, and improve how we use new software is an essential skill every one of our employees comes in the door with, and continues to develop while they’re here. And very often we find ourselves doing a mix of accounting work, process development, and tech setup and support all at the same time.

Which is all to say that we’re the perfect people to tell you that software will definitively NOT solve all of your problems, and can often make things worse.

So we need to approach our tech choices at arms length.

Here’s what we think about:

Selective Automation

Despite what the sexy SaaS landing page marketing will tell you…

With just a few simple clicks, we’ll do your taxes, walk your dog, and fix your relationship with your parents…

…implementing software and automation into the brewery is still “work,” it’s just a different type of work.

And so with every potential automation decision we need to ask ourselves whether the juice is worth the squeeze. In particular:

- The cost of the software itself. For most of what works well for small breweries, this is not (in our opinion) a significant deciding factor. Caveat: when we get into big-daddy-NetSuite-SAP enterprise software territory, the price tag skyrockets (not just for the software itself but also the customization and support) and it’s almost never appropriate for the size of business we’re dealing with.

- The cost of amplifying inefficiency. This one is real. It’s that handy Bill Gates quote: “The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.” Simply put: you can’t paper over a process problem with software.

- The cost of change. Oh baby, is this a big one. Because you know all of that stuff that although not perfect, currently works and gets the job done? We’re talking the team members you’ve trained, processes you’ve implemented, skills you’ve developed, other software you’ve hooked up, customer and product data you’ve collected… all of that needs to be considered, and is usually the primary issue we run into with new software.

But…

Thanks to APIs and some great small-business-focused software companies, there IS a better way.

The QBO Hub Model

Which brings us to our preferred brewery bookkeeping system setup with an official sounding name we just gave it this week: The QBO Hub Model.

It’s a customizable, plug-and-play setup that can work extremely well for any small brewery when implemented correctly, unlocking a beautiful symphony of efficiency, accuracy, and speed.

It can also make your head spin.

Because when those puzzle pieces aren’t put together correctly, we’re right back into garbage in, garbage out territory from yesterday with the added bonus of a magnified trail of destruction in our wake.

So.

Let’s walk through it piece by piece…

…keeping in mind that because it’s modular, each component is not an all-or-nothing. For every piece of the puzzle you have many options at your disposal on the sliding scale of “totally manual” to “complete automation,” almost always landing somewhere in-between.

- With that said, we’ll lay out both:

- What each piece needs to accomplish.

Our specific recommendations (i.e. what we’d most likely put into place if we commandeered your brewery).

Here we go.

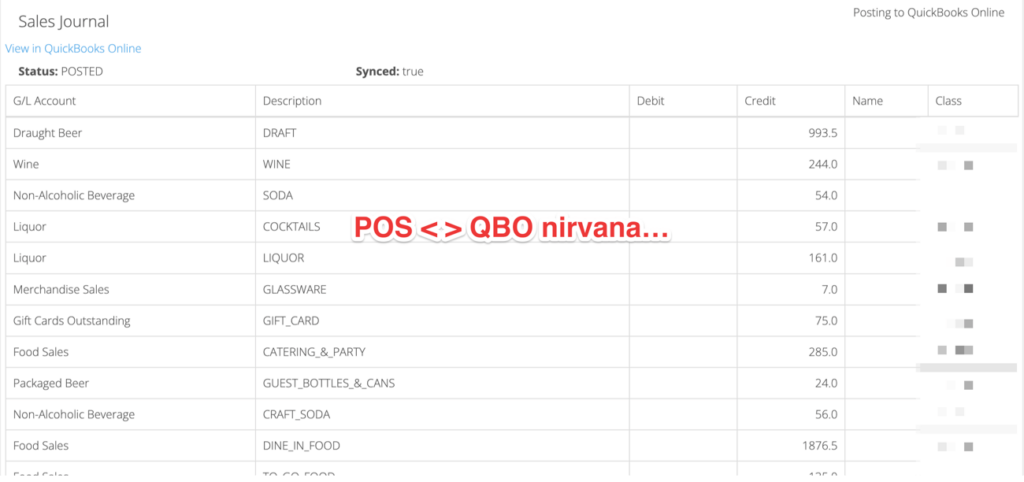

Income on Autopilot

The first, and if I might add, most important piece of the puzzle is the part where people give you money for the beer you produce.

Pretty cool right?

Well like we covered yesterday, there’s a bit more to the story than just connecting up a Square card reader to your bank account and accepting deposits. As a refresher, our bookkeeping principle for receiving income:

AR Principle 1: Every deposit matched to its source.

Our Recommendations

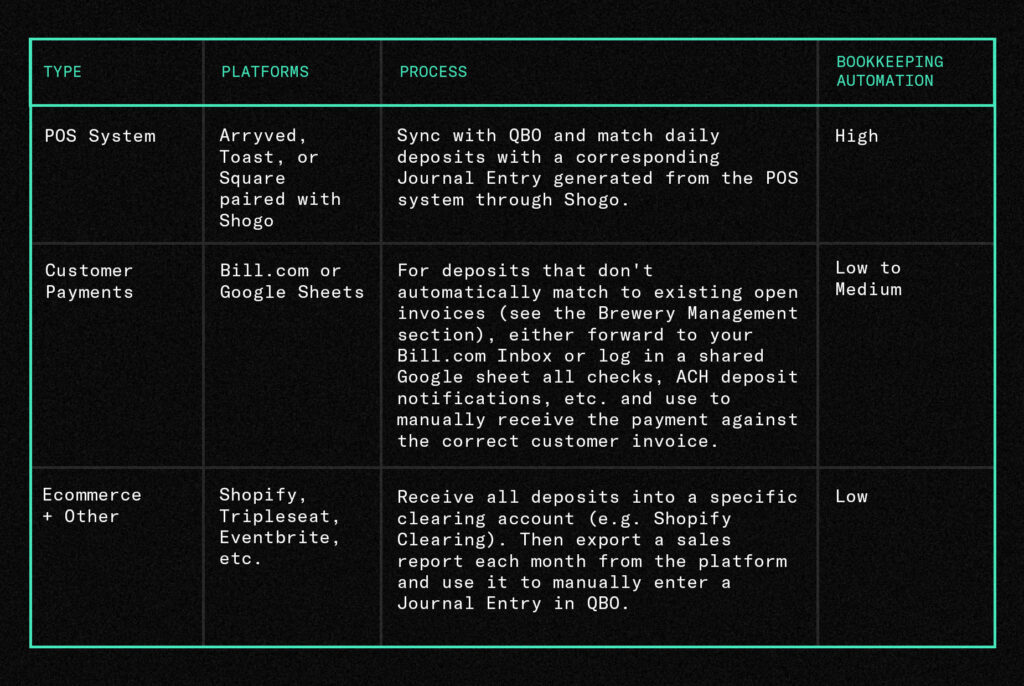

Here’s what we recommend for your income setup.

To summarize:

- We prefer POS systems that sync well with QBO, which is why Arryved, Toast, and Square are at the top of our list. There are plenty of others that work just fine, but require manual QBO entries.

- Ideally wholesale customer payments are matched to invoices automatically created by your brewery management software (see below). Regardless, you need a process in place to collect those all in one place and confirm that you’ve received payment for each.

- Ecommerce and other DTC or DTC-like sales platforms typically aren’t a major source of revenue and can be managed a bit more on the manual side.

And a final note on Shogo:

Many of these otherwise great POS platforms can get squirrelly with their out-of-the-box daily sales sync. For example, let the default Square sync run and you end with a whole mess of journal entries that can end up taking just as long to straighten out than if you’d just entered them in manually.

And so what we’ve found is that we need an extra layer of control over what gets mapped where. Enter Shogo to solve the problem.

#worthit

Total Production Flow

Next up is everyone’s favorite brewery software topic!

And this touches on just about every other element in the process.

Think about it like this: brewery management software is there to do all of the beer-specific detail work that QBO is not set up for out of the box.

The perfect scenario here is you just do your work, brew your beer, sell product to customers and all of the data and transactions are automatically collected and booked…

Short of that, what these pieces of technology do is get us as close to that as possible with (hopefully) convenient ways to enter in data that link as much of that information together as possible and minimize the amount of input needed from you, your team, and your customers in order to make everything work.

And so that’s the lens to view our recommendations through.

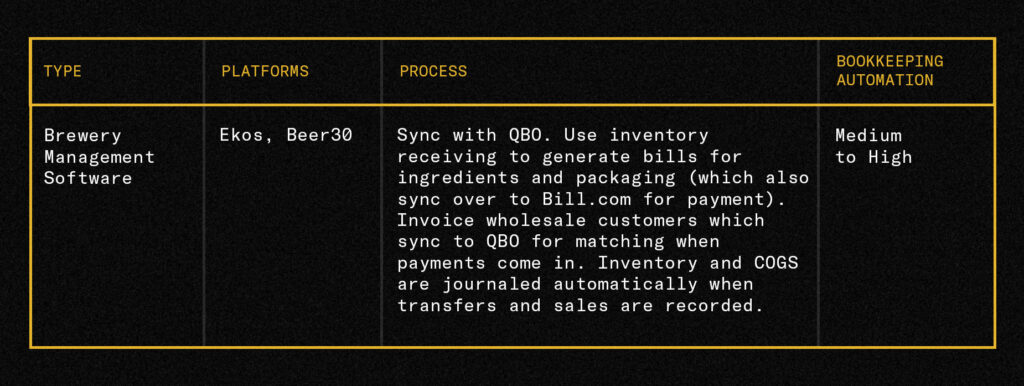

Our Recommendations

Apart from super-early-stage nano breweries…

We’re not quite sure how folks survive without one of these in place.

Because if you can actually use the system to “do you work” each day, keeping up with receiving materials, scheduling batches, recording transfers, and using it to sell product… everything else (for the most part) takes care of itself on the accounting side of things, meaning:

- It both creates all of the customer invoices that deplete inventory and give you that ever-elusive real COGS data you can then pull and determine if you’re actually making money on any of your beer.

- While at the same time allowing you to schedule out and manage production.

- And then order and receive all of the materials you need, generating bills in the process a material comes in the door, that can be matched up and paid through your bill pay platform (see below).

And in the end, even though the software won’t literally “do it for you,” it allows you to replace a massive amount of the manual work of making sure things were ordered, received, paid for, etc. and instead focus on the actual work of producing profitable alcohol.

Rock-Solid Expenses

Last but not least, the expense side of the equation.

And again like we talked about last chapter, the main reason we recommend the tools that we do is that regardless whether it’s a manual process of cutting checks, or everything is flowing through Bill.com… you need a system for determining what needs to be paid and when, and visibility to determine how that’s going to affect the cash you have on hand to run the business.

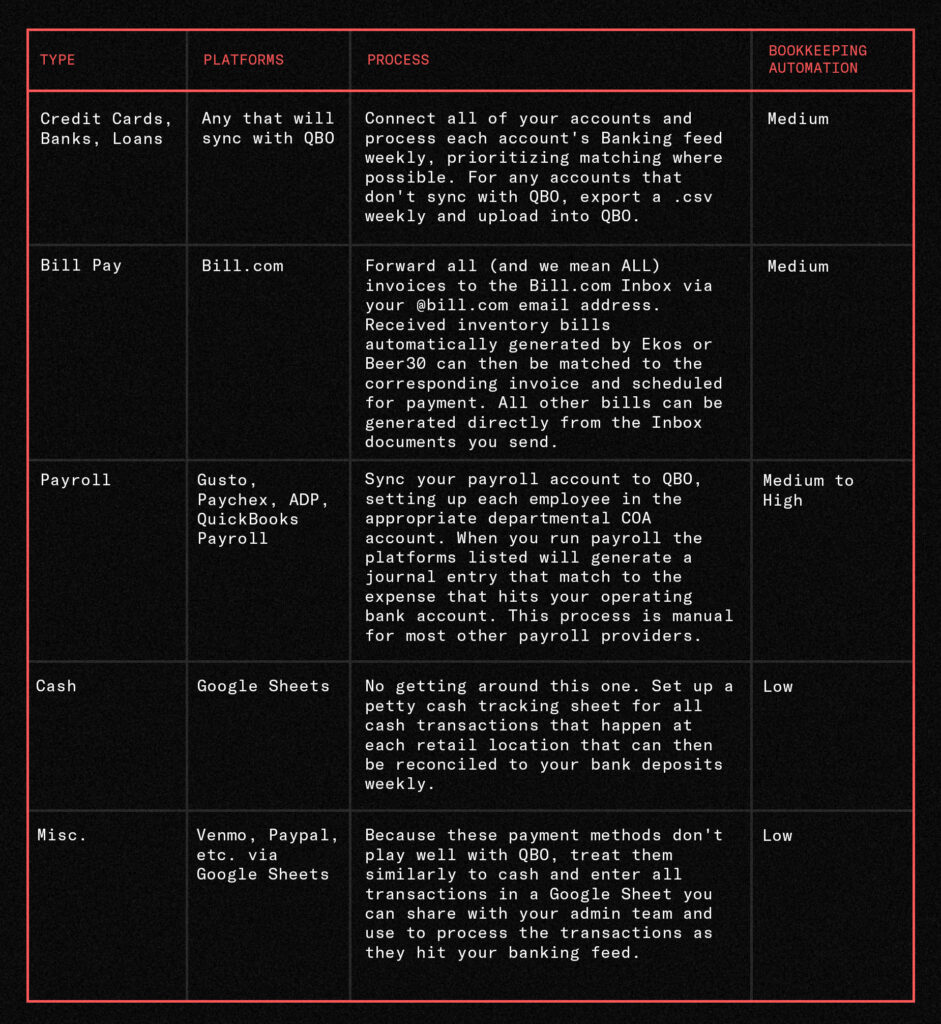

Our Recommendations

To summarize:

- Connect everything you can to QBO. This includes all of your accounts. This also includes your payroll system (which is why we recommend Gusto, Paychex, ADP and the like). The less external activity to keep track of, the better.

- Centralize bill pay. We’re always on the prowl for better solutions, but we have yet to find one more useful as a “complete” solution as Bill.com… even if you pay the majority of your bills via credit.

- There will still be things that fall outside of our system here. Cash is the primary offender, and there’s no way around keeping track of deposits and payments manually. However, there are also plenty of platforms out there that don’t play well with QBO that should be treated similarly.

Annnnd that’s a wrap!

Is it worth it?

I won’t sugarcoat this for you, it does require significant technical expertise in order to execute this.

In many ways you’re replacing the annoyance of having to execute this work manually with the annoyance of having to troubleshoot sync errors, entries that don’t match, and a whole array of other inexplicable occurrences that inevitable show up from time to time.

Most teams we encounter who are able to do this right either have:

- A significant level of finance and software skill within the core team, with oversight and direction from a single individual on the leadership team (i.e. the partner sitting in the “Director of Finance” seat).

- Someone external they bring in to help who’s been here and successfully executed before, whether a key hire, consultant, or outside firm.

With that said, the ROI when it does work is very, very high, particularly because every brewery is resource-constrained and needs work hard to maximize the leverage of their team members.

Which brings us back to costs…

And no, not the hard costs that show up on the P&L like we’ve been talking about…

I’m talking about the most important cost of them all:

Opportunity cost.

Good bookkeepers are fantastic at understanding costs.

Materials.

Leases and loans.

Payroll runs with tips and taxes.

The costs that you can see, that is.

Turns out, that while capturing and understanding those “direct” costs is absolutely necessary in order to run a tight financial ship at the brewery…

It’s far from SUFFICIENT to sustainably run one profitably.

Why?

Because underneath every direct cost lurks a larger set of hidden costs, often much bigger and consequential to the future success of the business.

The Uncomfortable Unknown

These hidden costs are what we fondly like to refer to as:

The uncomfortable unknown.

You know the uncomfortable unknown right?

That sweeping anxiety that strikes at 2am and overcomes your whole being and calls in to question everything you’ve ever done or ever will do as a business owner.

Anywho…

Apart from the direct costs associated with each activity necessary to operate the brewery, these hidden costs are often referred to as a combination of:

- Indirect costs. All of the costs upstream and downstream of the “thing” in question. Example: If your direct costs for beer production are ingredients, packaging, and production labor; your indirect costs are the brewhouse, tanks, facility, etc. (upstream) and things like sales tax, rep commission, taproom labor, etc. (downstream) that are required in order to successfully accomplish the goal of that thing: selling said beer.

- Opportunity costs. Here’s where things get spicy. Google says: “the loss of potential gain from other alternatives when one alternative is chosen. Example: idle cash balances represent an opportunity cost in terms of lost interest.” But that is faaaaar from complete. Because when you start to add up all of the alternative ways you could use the time, money, and brainpower associated with the “thing” you can go so deep as to question the meaning of life itself.

Why is this important?

The owners out there who are not only aware, but thrive in thinking through this type of cost analysis, are the ones that are more likely to come out ahead in the final equation.

Because they can not only better understand and take into account the long-ranging financial implications of this or that day-to-day decision…

But they also have the courage to confront the “uncomfortable unknown” head-on, which reduces (or at least moves through) fear and creates a bias towards action.

—

So today, as we approach the finale of this series of bookkeeping installments…

We’ll do one of these thought exercises for…

You guessed it…

Bookkeeping itself.

And with that, my intention is that we’re able to put all of what we’ve covered so far together and see a (more) complete picture of what the tradeoffs are with the various ways in which you can handle this (profit generating!) activity at the brewery.

Quick note before we begin:

Today’s exploration is a more thought experiment than math equation.

Because while we technically could “cost account” our way to the moon and back, I think it’s more useful (and honest) to leave it a bit rough. So each set of costs and options is more of an incomplete primer than an exhaustive list, designed just to get us thinking in the right direction.

Onwards.

The Direct Costs: The Nuts and Bolts

First up, the direct costs associate with actually doing the bookkeeping work.

No brainiac insights needed here so we’ll keep it short.

These are roughly:

- All of the software costs we covered last chapter. We’re talking: accounting software, brewery management software, POS systems, integration tools, etc. Sure, you aren’t paying for these things just to do bookkeeping alone… but at least some of the cost can be allocated there.

- Wages/fees for whoever you are paying to do the work. If you’ve hired a part-time bookkeeper or outsourced it to another firm, this is straightforward. If you’re using a portion of your time, or another team member’s time (e.g. your Office Admin, Taproom Manager, GM, etc.) then it’s a % of workload estimate multiplied by that person’s salary.

And that’s about it.

The Direct Costs: The Nuts and Bolts

These are both the upstream and downstream costs “attached” to the bookkeeping function.

Some upstream costs might be:

- The amount of time the production team has to spend on administrative work to capture all of the information needed (e.g. invoices, receipts, inventory counts, vendor communication, etc.).

- The time for whoever is taking on bookkeeping to learn to do it properly.

- Time to train an existing team member or new hire.

- The time to do that again if that first person doesn’t work out.

- The cost to recruit and hire someone with bookkeeping experience.

- Etc., etc.

Some downstream costs might be:

- Time to answer all of the questions from the team that only you can answer (a.k.a. death by a thousand questions).

- Expedite fees.

- Credit card interest and late fees.

- After-the fact research on transactions.

- Cleanup work you have to pay your accountant for.

- Negative tax implications.

- Interrupted production because there was a missed hops invoice and the product wasn’t shipped.

- Interest and penalties from incorrect compliance filings.

- Etc., etc.

Eesh… now we’re really starting to shine some light on the implications here.

The Opportunity Costs: A.K.A. Upside!

Last but far from least (and usually MOST), the opportunity costs!

And BTW, since I’m a chronically optimistic person, I prefer to frame these more as “unrealized upside.” As in, what MORE could I do with my time and money and effort that would add additional benefit to the business.

So yes, we’re saying “cost” here. But in practice that’s just the inverse of benefit. The lower the opportunity cost, the closer you are to maximizing your potential.

First category would be what else we could use the team’s time for:

- Expanding your distribution footprint.

- Promoting the brewery on social media.

- Creating events that drive interest and new customers.

- Researching and selecting more cost effective vendors.

- Planning production more efficiently to reduce waste and downtime.

- Brewing new recipes that have the potential to bring people into the taproom more frequently.

- And on and on and on…

Second (and this is a doozie), the owner’s time could instead be used for:

- Figuring out how to increase taproom pricing without impacting demand.

- Training your taproom staff to sell more product on a regular basis.

- Keeping your key team members engaged and happy.

- Recruiting and hiring the right people on the team in the first place.

- Regularly reviewing the financials and controlling spending.

- Holding your team members accountable for their performance.

- Sourcing bigger and better self-distribution accounts.

- Scouting out and negotiating favorable lease terms on your new taproom location.

- And on and on and on…

Third, we could look at what alternative financial decisions we could make with faster, more accurate information:

- Deciding to stop selling unprofitable beer.

- Making adjustments to team compensation.

- Deciding to renew your lease or move to a new location.

- Deciding to purchase additional equipment capacity at the right time.

- Kicking off the loan application process for capital you need for your next phase of expansion.

- And on and on and on…

And we could go on for days talking about investment vehicles and expansions and equipment and yadda, yadda, yadda…

You get the picture.

The 8th Wonder of The World

You didn’t think I would make it to another chapter without a cheesy quote from someone smart did you?

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

~ Albert Einstein

Because not only do your opportunity costs impact the business TODAY, they also compound.

Which means they have far-reaching implications into the FUTURE.

Now, this is where the finance brains out there start to marinate in a warm bath of their “future value of money” and “discounted cash flows” gobbledy-gook.

To keep it a bit more grounded in reality, let’s just put it like this:

- For a brewery currently making $1M in revenue…

- If the highest and best use of the owner/operator’s time is to grow the brewery…

- And the grand total of their fully realized efforts increase revenue by just 1% per week…

- By the end of 1 year, they’ve added $661,078.14 in revenue to the top line.

Now play that game for improving margin.

Now play that game for decreasing overhead.

Now play that game for increasing the productivity of the team.

Ya.

Pretty cool.

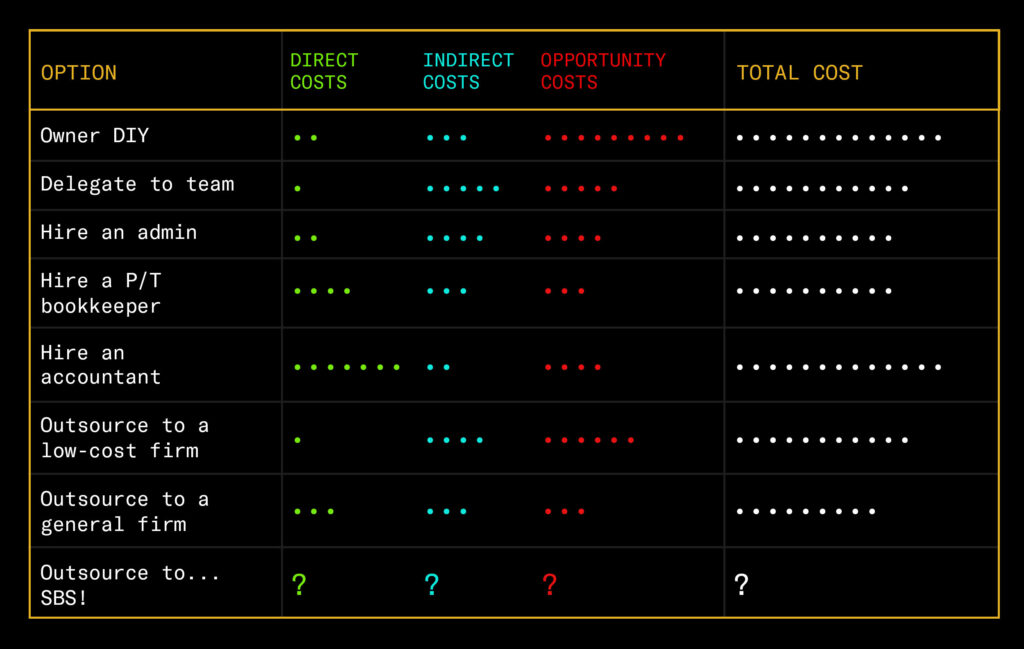

Putting It All Together

Ooookie dokie, let’s try to sum it all up here and take a look at a bunch of the options we could think up for how to tackle bookkeeping at the brewery.

If we were to attempt to actually do this math, we’d be looking at something to the effect of:

direct costs + indirect costs + opportunity costs = total cost of option

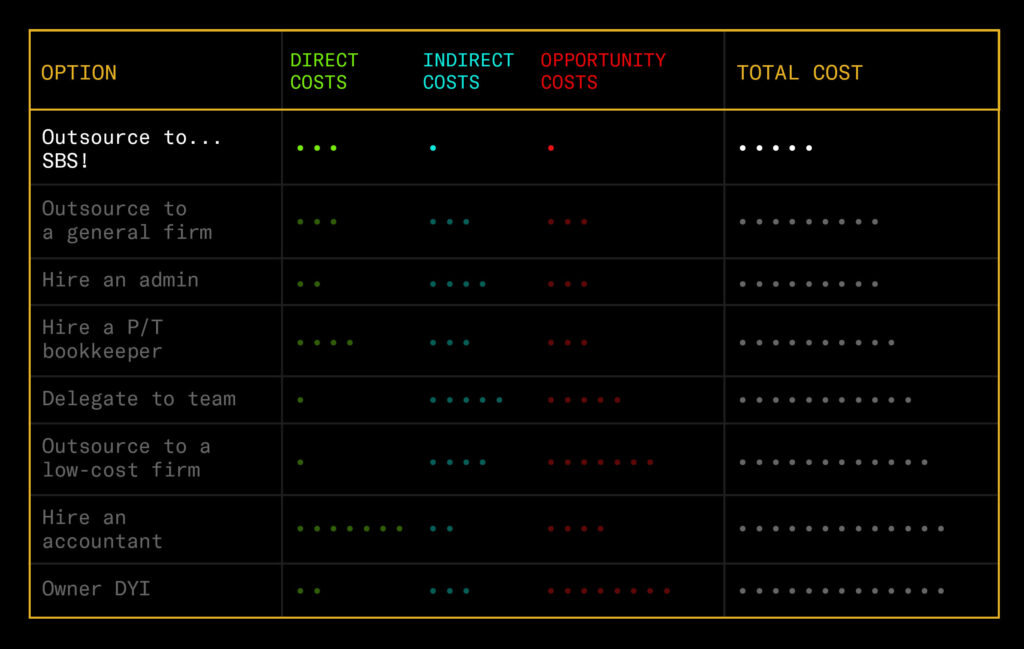

So keeping that math in mind, here’s what the approximate cost breakdown might look like for each:

Now, as we move to the right on this table, we get fuzzier and fuzzier in terms of pinning down the “actual” costs. But using this is a rough estimate, here’s how we’d break it down:

- Owner DIY. Judging by the conversations we have each week, I’d guess that most of you are here. Doing the work yourself well if you come from an accounting or finance background. Doing the work yourself poorly if you’re inexperienced, it isn’t your strong suit, or you’re just simply too busy. Either way, you’re trading this for a bunch of indirect costs of not executing quiiiite by the book, and for the biggest tradeoff of all: the compounding impact your time could have elsewhere in the business.

- Delegate to your current team. You know… that thing where you give your Taproom Manager another responsibility that they’d rather not take on but do anyway because they don’t want to say “no” to you. And then maybe even give it a valiant effort, but because they have a million other things to do and don’t have the skill set needed, create the type of mess that requires lots of indirect cost compensation, not to mention all of the other things they could be doing with that time to benefit the brewery.

- Hire an admin. To spend some of their time on bookkeeping. This can actually work quite well… however because most administrative folks don’t have a fully-developed bookkeeping skill set, unless you REALLY nail it on the hiring front, you’re likely creating a pretty large mountain of cleanup work for yourself down the road.

- Hire a part-time bookkeeper. Good option… EXCEPT. The barrier to entry for putting the title Bookkeeper on your resume and setting up shop is approximately 0%. To give you a sense of this, we hire 1 Accounting Associate for every ~700 applications we receive. And our applications are a doozie. So there’s a pretty significant risk tradeoff here unless you really know what you’re looking for and have experience doing this before.

- Hire an accountant. Who you don’t need full-time. Seriously. I can honestly say we’ve received applications from and/or interviewed hundreds of accountants who work either in breweries or in parallel roles (restaurant, small manufacturing, etc.) and have hired a grand total of ZERO who have worked out. Not that they aren’t great people (some of them) or do a great job (some of them), but the actual “accounting” work is actually only a small % of the work they’re actually doing day-to-day. So having an accountant do this work is great from a skills perspective if you can find the right hire, but essentially you’re paying 2x for the actual bookkeeping work, and often paying the other, say 50-75% of their salary for a ton of time spent doing “other things” of questionable value.

- Outsource to a low-cost firm. These are the folks who pull the same ‘ole trick as the SaaS marketers. Low cost! Amazingly easy! Life changing! Until you realize they’re either (a) just booking stuff the way a 10-year old would (sorry nvm, that’s actually offensive to 10-year-olds), or (b) copy-pasting all of your transactions back into a massive lists of questions to send right back to you… which ends up taking just as long to explain as it would have to just do it yourself. Pass.

- Outsource to general firm. As in, they are professionals, and you pay accordingly. Usually 2-3 names on the door. And they do a great job with the bookkeeping and accounting work. Not such a great job with the understanding your business part. And in order for this to work, again the brewery’s owners need to be quite experienced in making these types of “hires.” Or get lucky and land on a diamond in the rough. YMMV.

Oh and hmm…

…

Who put that last one there?

Outsource to…

SBS!?

We’ll leave that one out there as a mystery to be unveiled in our final chapter coming up next.

To Wrap Up

I’m going to be honest here.

We’ve laid it all out…

Exactly how we view the problem, how we approach it, what needs to be done, and how to do it efficiently.

We could say that you can just go ahead and do it yourself, with your existing team, or go out and hire someone and hand them the blueprint.

But, even acknowledging that I can’t know the specifics of your business, I’d likely be lying to you if I said that.

The truth is, you should probably just hire us.

So no bones about it, I’ll make that case in our final chapter.

And then leave it in your hands to decide whether that makes sense.

Either way, much gratitude as always for reading.

We made it!

The finale of our bookkeeping series.

And because we just happened to do a deep dive into the opportunity cost of your time to the brewery…

I’ll practice what I preach and give you the short and sweet version.

First, to follow up from chapter four, here’s where (in our of course biased, but honest opinion) we believe SBS Bookkeeping lands on the “value scale” from yesterday. High quality, streamlined, and custom-built from the ground up for brewery owners, our aim is to get our clients the information they need, when they need it, and put time back in their hands to reinvest in the business.

And of course, that’s where it should sit! Because if it wasn’t, I wouldn’t have just spent almost 10,000 words writing about what many consider one of the most boring topics of all time… and we’d have some serious soul-searching to do. This is quite literally our entire reason for existing as a firm.

Second, give our updated bookkeeping service page a look, which lays out exactly how we work with brewery owners and their teams to accomplish all of the objectives we’ve covered this past week. And keep in mind: this is the first published installment of our redesigned service packages. They’re modular and customizable; priced based on brewery size, complexity, and level of support needed; and able to better fit with the existing resources, team, and process within the brewery.

Third, I’d like you to book a discovery call with us. If there’s even an inkling that we could help your business in this way, I promise it’s worth your while to have a conversation. It’s not a pitch, and we don’t convince. It’s a two-way conversation, and one entirely focused on whether we could add value. We wrap up on a mutual “no” or “not right now” just as often as we move on to discuss an engagement. But almost without fail, the clients who do decide to work with us, routinely wish they had decided to reach out sooner.

Here’s the link again:

And that’s it!

Finito.

Done.

Thanks for reading along.

– Tom